The collapse of Silicon Valley Bank earlier last week has raised concerns about the efficacy of financial regulations put in place after Trump rolled back regulations. Many experts argue that the bank’s collapse could have been prevented if not for the Trump Administration’s dismantling of key sections of the Dodd-Frank regulations.

What is Dodd-Frank?

The Dodd-Frank Wall Street Reform and Consumer Protection Act, also known as Dodd-Frank, was signed into law in 2010 by President Barack Obama. The law was a response to the financial crisis of 2008, which resulted in the collapse of major financial institutions and caused widespread economic hardship.

Dodd-Frank was designed to prevent future financial crises by imposing new regulations on banks and other financial institutions. The law contained several key provisions, including:

- Consumer Financial Protection Bureau (CFPB): Dodd-Frank established the CFPB, which was tasked with protecting consumers from abusive financial practices.

- Financial Stability Oversight Council (FSOC): The FSOC was created to monitor and address systemic risks to the financial system.

- Volcker Rule: The Volcker Rule prohibits banks from engaging in proprietary trading with their own funds.

- Increased Capital Requirements: Dodd-Frank required banks to hold higher levels of capital to protect against losses.

These provisions were designed to increase transparency and accountability in the financial sector and prevent banks from engaging in the risky behaviour that contributed to the 2008 crisis.

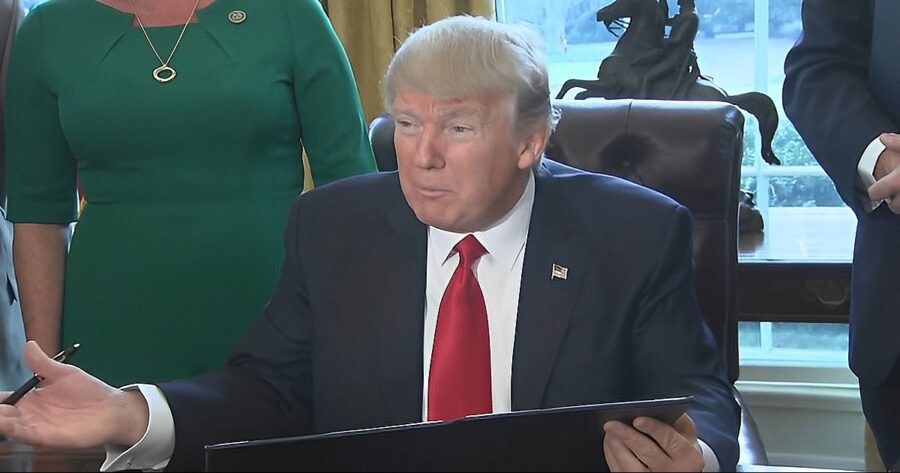

In May 2018, President Donald Trump signed the Banking Bill, which rolled back many of the regulations put in place by Dodd-Frank. The bill raised the threshold for banks to be considered “too big to fail” from $50 billion in assets to $250 billion. This meant that many smaller banks were no longer subject to the same regulations as larger banks.

The rollback of Dodd-Frank regulations was central to Trump’s deregulatory agenda. The Trump Administration argued that the regulations put in place by Dodd-Frank were too burdensome and hindered economic growth. However, many experts warned that rolling back these regulations could have catastrophic consequences. By reducing the oversight and regulations on banks, there was a greater risk of banks engaging in risky behaviour and making poor investment decisions that could lead to their collapse.

Silicon Valley Bank was a smaller bank with assets under $209 billion. Under Dodd-Frank, the bank would have been subject to stricter regulations and oversight. However, under the Banking Bill signed by Trump, smaller banks like Silicon Valley Bank were exempt from many of these regulations.

Critics argue that this exemption allowed banks like Silicon Valley Bank to engage in risky behaviour without sufficient oversight. They argue that if the regulations put in place by Dodd-Frank had not been rolled back, Silicon Valley Bank may have been better equipped to weather the economic challenges of the COVID-19 pandemic and avoid collapse.

Dodd-Frank was designed to prevent future financial crises by imposing stricter regulations on banks and other financial institutions. The rollback of these regulations by the Trump Administration has raised concerns about the potential for another financial crisis in the future.

Critics argue that the deregulation of the financial sector under the Trump Administration could lead to a repeat of the 2008 financial crisis or even worse consequences. They argue that the rollback of Dodd-Frank regulations has allowed banks to engage in risky behaviour without sufficient oversight, potentially putting the financial system’s stability at risk.

The collapse of Silicon Valley Bank serves as a warning about the dangers of deregulation and the need for strong financial oversight to protect the economy from another financial crisis. It also highlights the importance of effective management and oversight of financial institutions, particularly during times of economic uncertainty.

In the wake of the collapse of Silicon Valley Bank, there have been renewed calls for stronger financial regulations to prevent future financial crises. The Biden Administration has signalled its intention to restore some of the regulations rolled back under the Trump Administration, including strengthening the CFPB and increasing oversight of the financial sector. However, there is still debate about the appropriate level of regulation and oversight needed to protect the financial system without stifling economic growth.

Ultimately, the future of financial regulation is likely to be shaped by ongoing debates about the appropriate balance between regulation and economic growth. However, the collapse of Silicon Valley Bank serves as a powerful reminder of the importance of effective financial regulations and oversight in protecting the stability of the financial system and the broader economy.