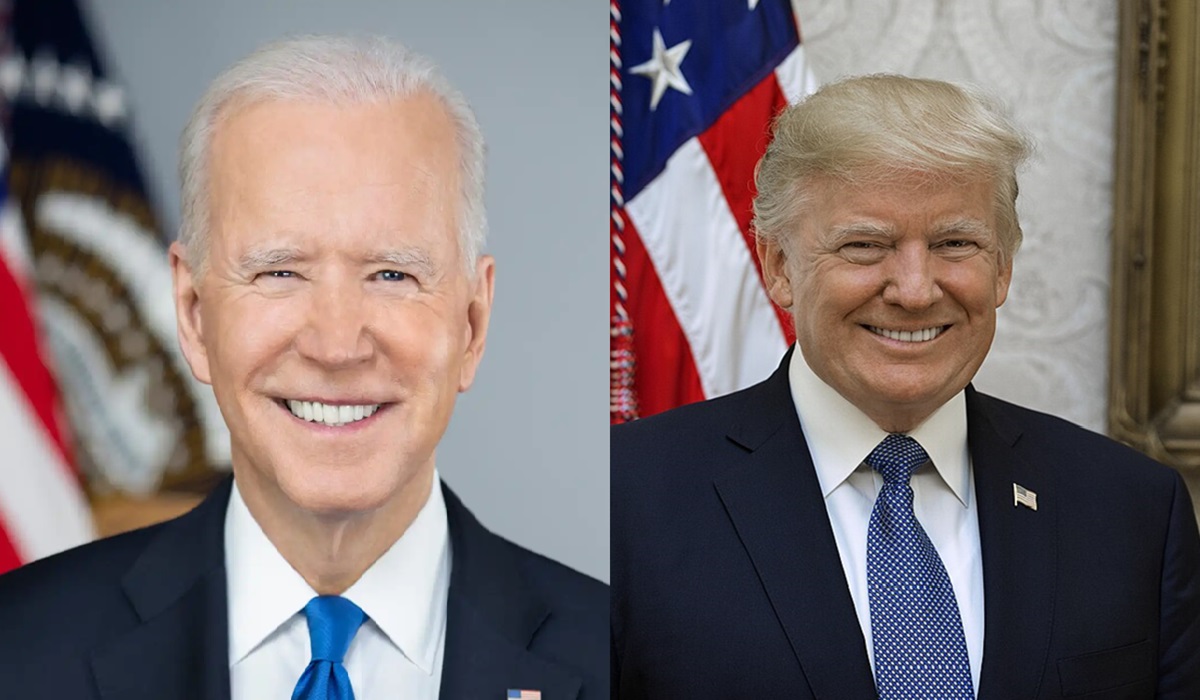

Although Trump’s shady organizations were convicted, he was not charged

The Trump Organization was found guilty of all 17 charges that it faced – including felony tax fraud, falsifying business records, conspiracy, and related crimes – after two days of arguments at Manhattan Superior Court. A Manhattan jury has found two of the Trump Organizations companies guilty of several counts of criminal tax fraud and falsifying business records stemming from a 15-year scheme to defraud tax authorities by failing to report and pay taxes on the compensation of top executives.

The 15-year scheme to defraud tax authorities by failing to report and pay taxes on the compensation of top executives. Former President Donald Trump’s companies were found guilty on all 17 charges on Tuesday in the Manhattan District Attorneys Office case related to the Organization’s shady financial practices.

A wide-ranging investigation examined whether Donald Trump deceived banks and others about the value of his properties, golf courses and other assets, which is the subject of a lawsuit the New York State Attorney General filed against him.

The Manhattan district attorney’s office also looked into whether any state laws were violated when allies of Trump made hush money payments to two women who said they had sexual encounters with the former President years ago. Late in his term last year, former Manhattan District Attorney Cy Vance instructed deputies to produce evidence for a grand jury that could lead to an indictment. Defence attorneys asked witnesses some 60 times whether Donald Trump, a former President, knew of a tax scheme involving his businesses while trying to prove that Trump was unaware of criminal tax fraud.

The 17 counts, which amount to one defrauding scheme, would not have made much difference financially for former President Donald Trump’s company since they carried a maximum fine of just $1.62 million.

Prosecutors needed to convince a jury that the former company’s financial director, or a lower-level employee who worked with him on the scheme, was a key management operative acting on behalf of the Organization and benefitting the company.

According to him, Trump Organization saved money because it paid lower taxes on its off-the-books compensation, and he admitted, upon questioning by prosecutor Susan Hoffinger, that the scheme provided benefits to the company as well, even though its primary purpose was to avoid taxes.

Former Trump Organization’s Chief Financial Officer Allan Weisselberg said he and his subordinates knew at the time that Trump Organization would pay less payroll taxes as part of the scheme. However, he said they never discussed it directly with Trump. Both companies contend Weisselberg was responsible for a criminal tax-fraud scheme and that he implemented the system for his personal benefit.

According to Weisselberg, Trump Corporation paid its expenses on the tax bill, and Trump approved its practice. The Trump Corporation also covered Weisselbergs utility bills and parking garage fees, a 2021 indictment alleged.

Two entities- the corporation and the Trump Payroll Corporation- were accused of paying for the personal expenses of certain executives without reporting it as income and compensating certain executives as independent contractors rather than full-time employees. The company was convicted of all nine charges that it faced, and the Trump Payroll Corporation was convicted on an additional eight counts.

The Trump Organization and its longtime former Chief Financial Officer, Allen Weisselberg, were charged last year following a multiyear investigation of the Trump Organization’s financial practices by the Manhattan District Attorneys Office. During the trial, prosecutors said that over 15 years, the Trump Organization helped senior executives evade income taxes on a litany of off-the-books benefits, including rental housing, private-school tuition, and luxury cars.

Prosecutors throughout the trial contended Trump and the Trump businesses were fully aware Calamari, Weisselberg and Controller Geoffrey McConney were engaging in practices that provided execs with untaxed income via benefits. One of the critical components of the Manhattan case against Trump’s companies was the testimony of Allen Weisselberg, a former financial manager who pleaded guilty to manipulating company books to lower his taxes on $1.7 million in fringe benefits.

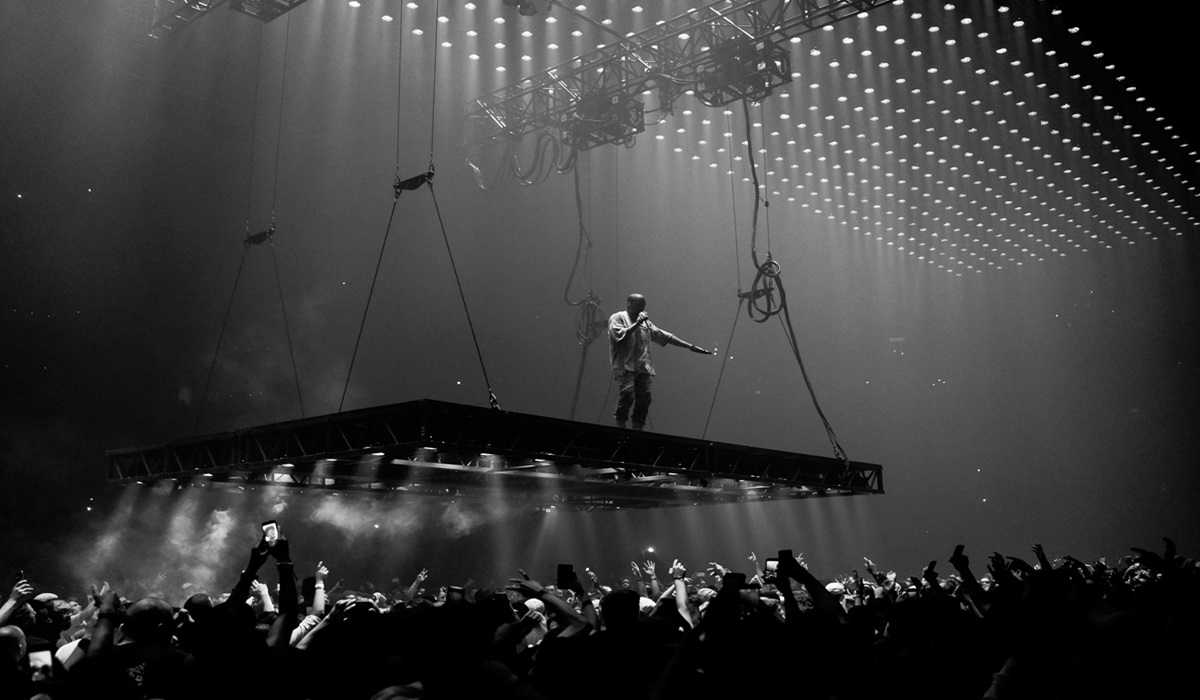

Trump’s lawyers called only one witness on facts, the real-estate firm’s longtime accountant, Donald Bender of Mazars U.S.A., who dropped Trump as a client earlier this year. The convictions also came amidst Donald Trump’s self-inflicted crises over recent weeks, including his outrage at dine-ins with the Holocaust-denying white nationalist and the anti-Semitic rapper formerly known as Kanye West. Trump also called for the termination of all rules, regulations, and articles, including those in the Constitution. This is to resolve his unfounded claims about massive voter fraud.