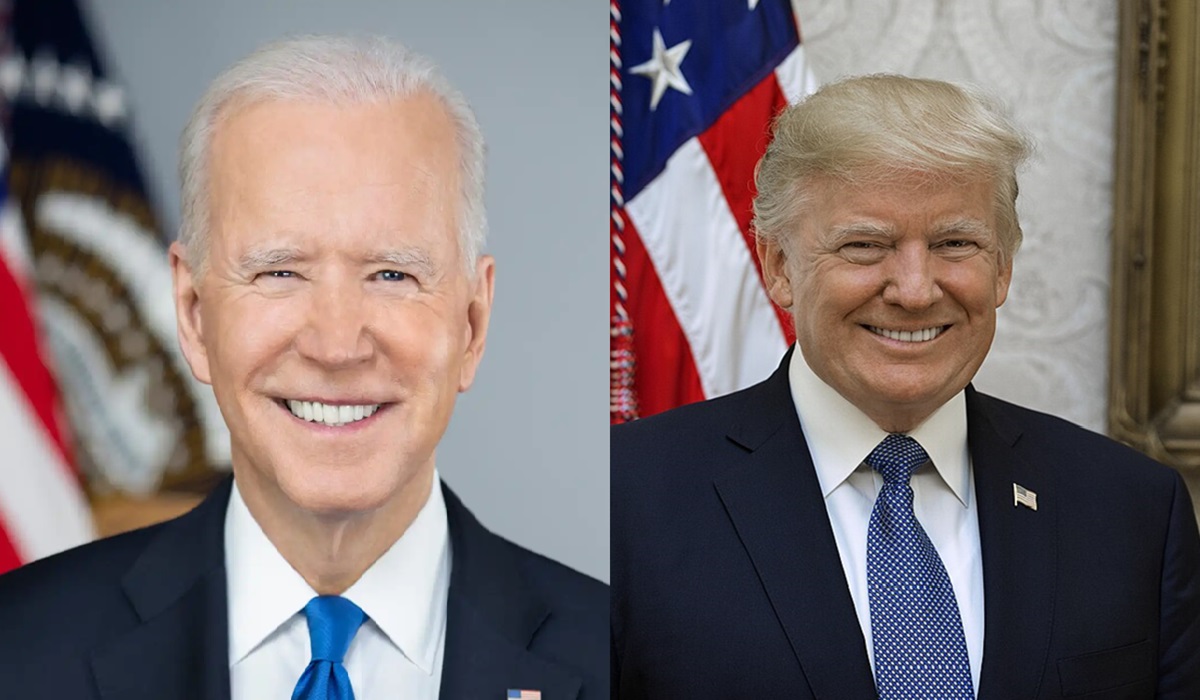

The Republican Party’s Fair Tax Act, also known as the “Tax Cuts and Jobs Act,” was introduced in 2017 and proposed to overhaul the current tax code by replacing all federal income taxes with a flat 30% consumption tax. This includes eliminating individual and corporate income taxes, payroll taxes, estate taxes and the Internal Revenue Service (IRS).

Proponents of the Fair Tax Act argue that it would simplify the tax code and stimulate economic growth by allowing Americans to keep more of their money. They also argue that lowering the corporate tax rate would make the United States more competitive in the global economy.

However, political pundits and critics of the Fair Tax Act argue that it would primarily benefit the wealthy and large corporations while disproportionately harming low- and middle-income Americans. They argue that the consumption tax would hit low-income individuals the hardest, as they spend a larger portion of their income on necessities such as food and housing.

Additionally, the Fair Tax Act would eliminate deductions and credits that many Americans rely on, such as the mortgage interest deduction and the child tax credit. Critics also argue that the elimination of the estate tax would primarily benefit the very wealthy and that the elimination of the corporate income tax would lead to a loss of revenue for the government.

One of the main arguments against the Fair Tax Act is that it would significantly increase the national debt. According to multiple watchdog organizations, the Fair Tax Act would decrease federal revenue significantly in the first decade. This is because the 30% consumption tax would not generate enough revenue to replace the lost revenue from eliminating income and payroll taxes.

Moreover, political analysts have also pointed out that the Fair Tax Act would be a gift to the Democrats as the bill would be regressive in nature and would disproportionately affect the lower-income groups and the middle class. This might lead to a significant loss of support for the Republican Party among these groups in the upcoming elections. Additionally, it would significantly increase the national debt. It would be a gift to the Democrats as it would lead to a significant loss of support for the Republican Party among the lower-income groups and the middle class.