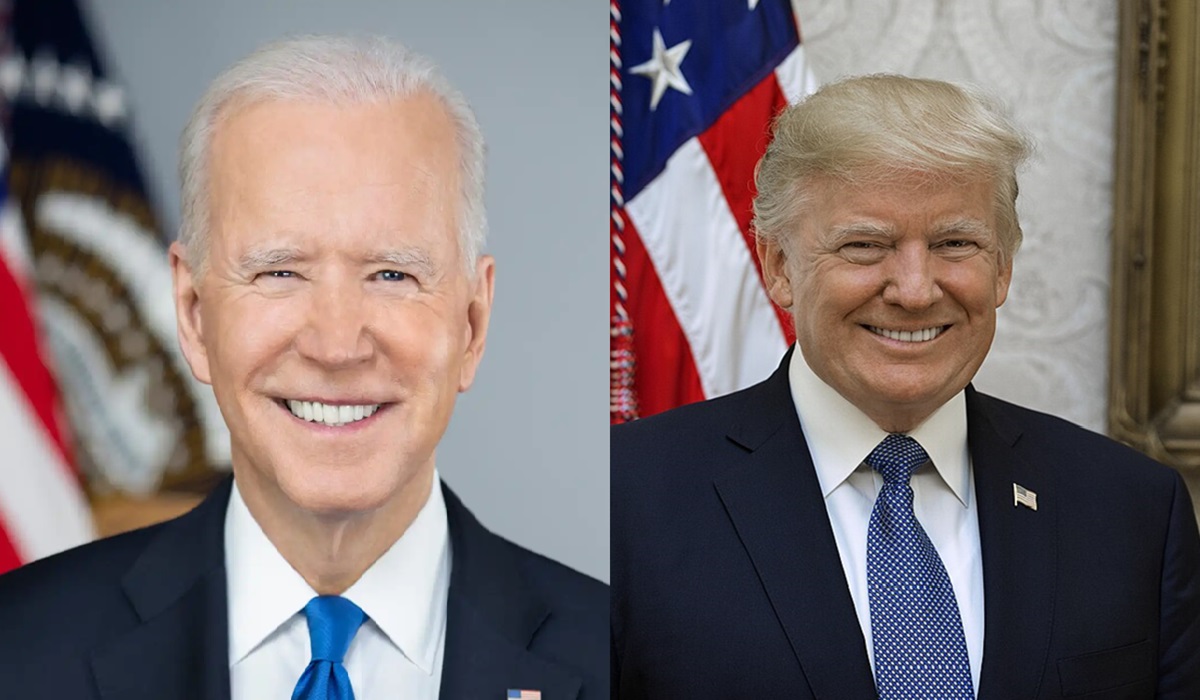

The discourse surrounding equitable taxation and its implications for the wealthy continues to be a hot-button talking point on the election trail, a central topic in income inequality and fiscal responsibility discussions. While taxing the rich appears straightforward, a closer examination reveals a multifaceted reality. Notably, an emphasis must be placed on the intriguing dynamics that many elected officials, serving at the federal and state levels, amass substantial wealth, leveraging their positions for financial gain and benefiting from intricate tax codes.

A compelling facet of the discussion centers on the financial status of those entrusted with creating and enforcing tax laws. A significant number of individuals in Congress, state legislatures, and gubernatorial positions entered public service with considerable wealth or have skillfully transformed their time in office into a lucrative career. Throughout their tenures, they’ve been able to capitalize on the various loopholes and deductions embedded within the U.S. tax codes to effectively reduce their tax obligations. This intriguing reality presents an inherent conflict of interest as lawmakers may be reluctant to enact legislation that would adversely affect their own financial well-being.

A critical component of this narrative lies in the intersection of lawmakers’ interests and their ownership stakes in significant corporations. This dynamic can complicate introducing laws or policies that might impede their personal gains. The intricate web of connections between corporate ownership and public service raises concerns about the impartiality of legislation that affects corporate taxation. This intricate relationship makes it arduous to wholly ensure that tax laws are equitable and unbiased.

When discussing how the wealthy seem to “manipulate” the tax system, a more accurate term might be “strategic tax planning.” The U.S. tax code is intricate and offers numerous deductions, credits, and incentives that individuals and corporations can legitimately utilize to lower their tax liability. For instance, businesses can take advantage of deductions related to R&D investments, depreciation, and other business-related expenses. The effectiveness of these strategies lies in how the tax laws are written.

As discussions surrounding taxing the rich persist, it’s crucial to recognize that the dynamics are more intricate than they initially appear. The notion of making the wealthy pay their fair share becomes entwined with the complexity of corporate tax structures and the nuanced understanding that those with significant financial resources often possess. Indeed, the accessibility of comprehensive financial advice for individuals of substantial means underscores the challenge of imposing blanket tax reform.

Addressing the issue of taxing the rich also raises questions about economic impact. Certain deductions and incentives are designed to encourage business growth and job creation. For example, favorable tax laws for corporations and business owners can stimulate economic activity by enabling them to invest in their enterprises and hire more employees. It’s essential to strike a balance between incentivizing economic growth and ensuring tax fairness. To effectively address the concept of equitable taxation, a deeper understanding of the complex interplay between wealth, political power, and the tax system is required. Only then can informed decisions be made about how best to ensure a fair and just tax structure that benefits all members of society.