South Africa is witnessing a surge in cashless transactions, driven by tech-savvy retailers and a growing appetite for digital convenience. However, concerns linger about whether this wave is leaving behind the unbanked and exacerbating existing inequalities.

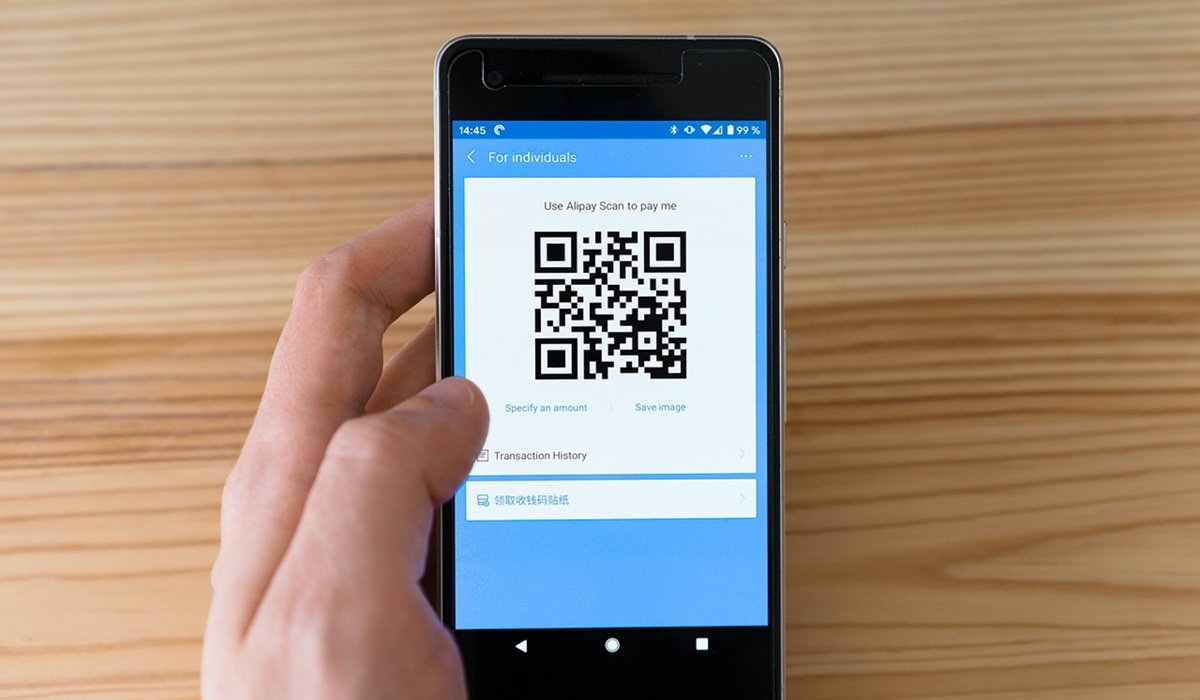

From bustling supermarkets to trendy cafes, South African businesses are embracing digital payment solutions. QR code payments, mobile wallets, and contactless card readers are becoming increasingly ubiquitous, offering faster transactions and streamlined record-keeping. This shift is fueled by a tech-savvy generation of consumers and a concerted effort by retailers to stay ahead of the curve.

Despite the momentum, a significant hurdle remains: the unbanked population. Nearly 25% of South Africans lack access to formal financial services, making them ineligible for most cashless options. This digital divide risks excluding a large portion of the population from the economic and social benefits of a cashless society.

To bridge this gap, initiatives are underway to promote financial inclusion. Government programs are expanding access to bank accounts and mobile money platforms. Fintech startups are developing innovative solutions tailored to the needs of the unbanked, such as offline payment systems and micro-insurance products.

While South Africa’s journey towards a cashless future is nascent, it can glean valuable lessons from China, a global leader in digital payments. China’s rapid transition was fueled by factors like robust government support, widespread internet penetration, and a tech-driven entrepreneurial ecosystem. However, its success also came with challenges, including concerns about data privacy and the potential for social exclusion of the elderly and rural communities.

South Africa must navigate its own path, drawing inspiration from China’s successes while acknowledging its unique context. Striking a balance between promoting digital adoption and ensuring financial inclusion will be crucial. Investments in digital literacy, accessible infrastructure, and data security will be essential to build a truly inclusive cashless future.

The cashless revolution in South Africa is far from over. While challenges remain, the potential benefits of a digital economy are undeniable. By addressing the issue of financial inclusion and learning from global experiences, South Africa can build a cashless future that benefits all its citizens.