Government Announces Climate Action Incentive Payment Amounts For 2020

- TDS News

- Atlantic Canada

- Eastern Canada

- Northern Canada

- Western Canada

- December 17, 2019

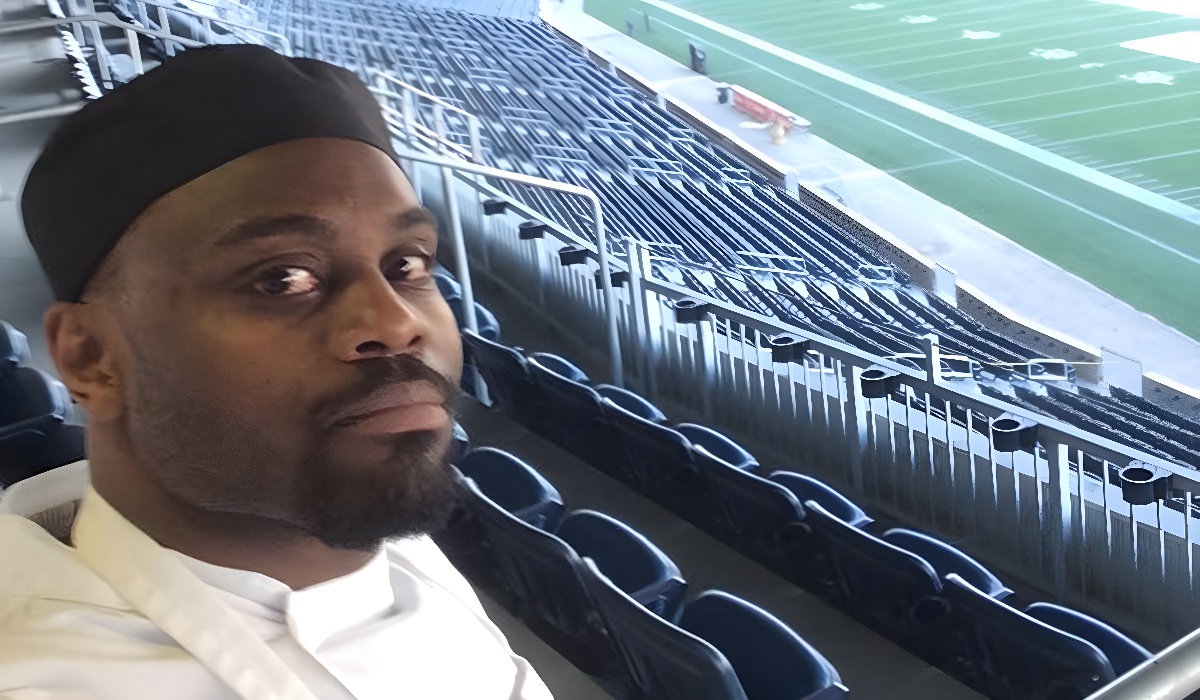

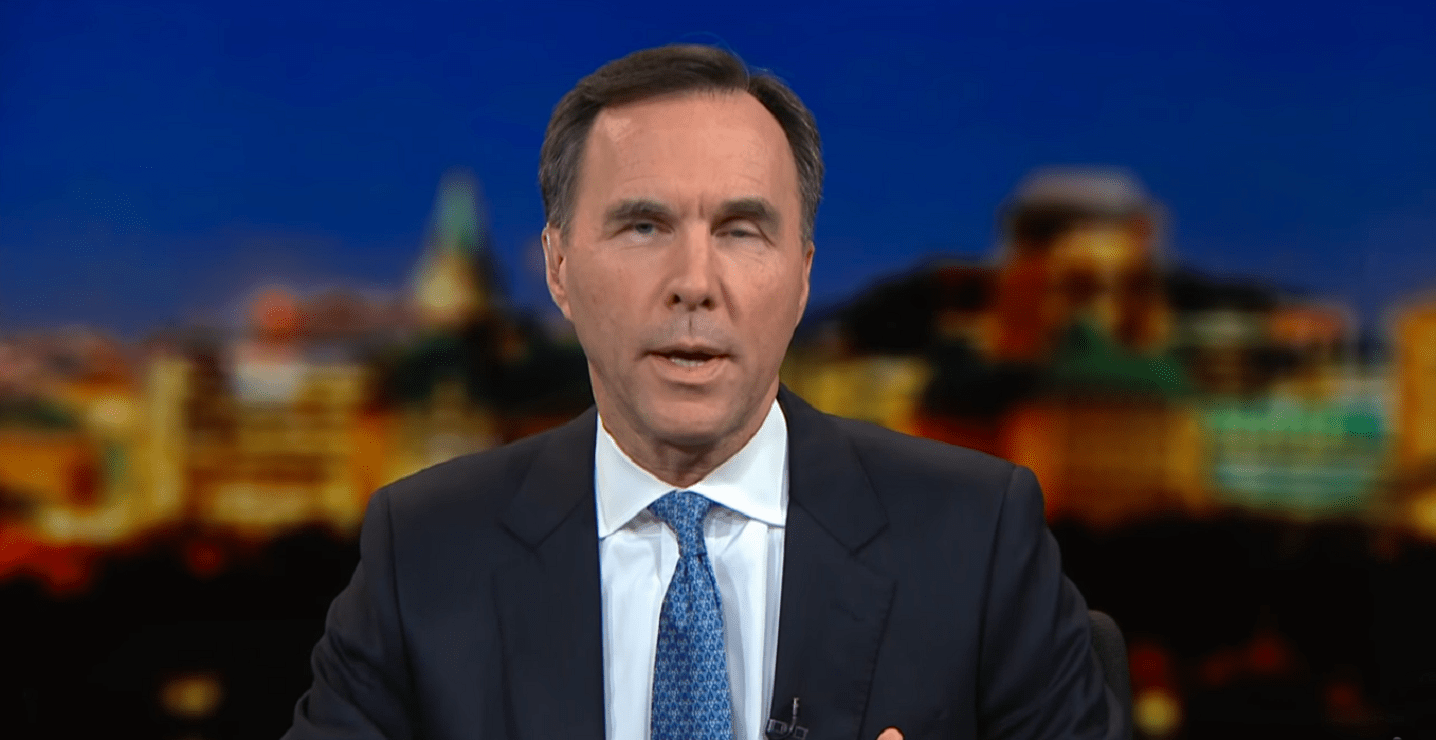

December 16, 2019 – Minister of Finance Bill Morneau announced the 2020 Climate Action Incentive payment amounts for residents of provinces that have not adopted the federal system or otherwise met the federal stringency requirements for pricing carbon pollution: Ontario, Manitoba, Saskatchewan and Alberta. Individuals will be able to claim these amounts through their 2019 personal income tax returns.

About Climate Action Incentive Payments

To protect Canadians from the dangers and costs presented by climate change, and to ensure that Canada continues to reduce its greenhouse gas emissions, the Government introduced a price on carbon pollution across Canada in 2019.

This includes a plan that sees the direct proceeds from carbon pollution pricing generated under the federal system returned to the province or territory of origin. Direct proceeds from the federal fuel charge are returned either directly to governments (where the federal system has been voluntarily adopted) or to individuals and families through tax-free Climate Action Incentive payments and to targeted sectors, including small and medium-sized businesses, schools, hospitals, non–profits and Indigenous communities. Most households receive more in Climate Action Incentive payments than they incur in total costs resulting from the federal carbon pollution pricing system.

The Government of Canada does not keep any direct proceeds from carbon pollution pricing.

Climate Action Incentive Payment Amounts, as Specified by the Minister of Finance, for 2020 (Delivered Through 2019 Personal Income Tax Returns)

| Ontario | Manitoba | Saskatchewan | Alberta | ||

| A | Single adult, or first adult in a couple | $224 | $243 | $405 | $444 |

| B | Second adult in a couple, or first child of a single parent | $112 | $121 | $202 | $222 |

| C | Each child under 18 (starting with the second child for single parents) | $56 | $61 | $101 | $111 |

| Example: Baseline amount for a family of four | $448 | $486 | $809 | $888 |

| Note: Exceptionally, the 2020 Climate Action Incentive payment claimed by eligible Albertans will reflect fuel charge proceeds generated over a 15-month period. This consists of three months (January–March 2020) with a carbon price of $20, plus 12 months (April 2020–March 2021) with a carbon price of $30. |

Quotes

“Putting a price on carbon pollution is the most effective and efficient way to reduce the greenhouse gas emissions associated with climate change, but Canadians are also concerned about what that price might mean for their own pocketbooks. That’s where the Climate Action Incentive payments come in. Most households will receive more money back through these payments than what they will pay out due to federal pollution pricing—helping families to make ends meet as we move toward a cleaner future.”

– The Honourable Bill Morneau, Minister of Finance

“In Canada and around the world, we’re seeing growing momentum for pricing carbon pollution because it works. Putting a price on pollution is a cost-effective way to cut pollution and deliver clean growth. And returning revenues from that price to households helps keep life affordable for Canadian families.”

– The Honourable Jonathan Wilkinson, Minister of Environment and Climate Change