A recession is a period of economic downturn characterized by a decline in economic activity, such as GDP, employment, and trade, typically lasting for a few months to a couple of years. Recessions are often accompanied by a fall in asset prices and a rise in bankruptcies and unemployment.

The last recession in Canada occurred in 2020 and was caused by the global COVID-19 pandemic. The pandemic led to widespread lockdowns and restrictions on travel and economic activity, which had a significant impact on the Canadian economy. Many businesses were forced to close or scale back operations, and there was a sharp increase in unemployment.

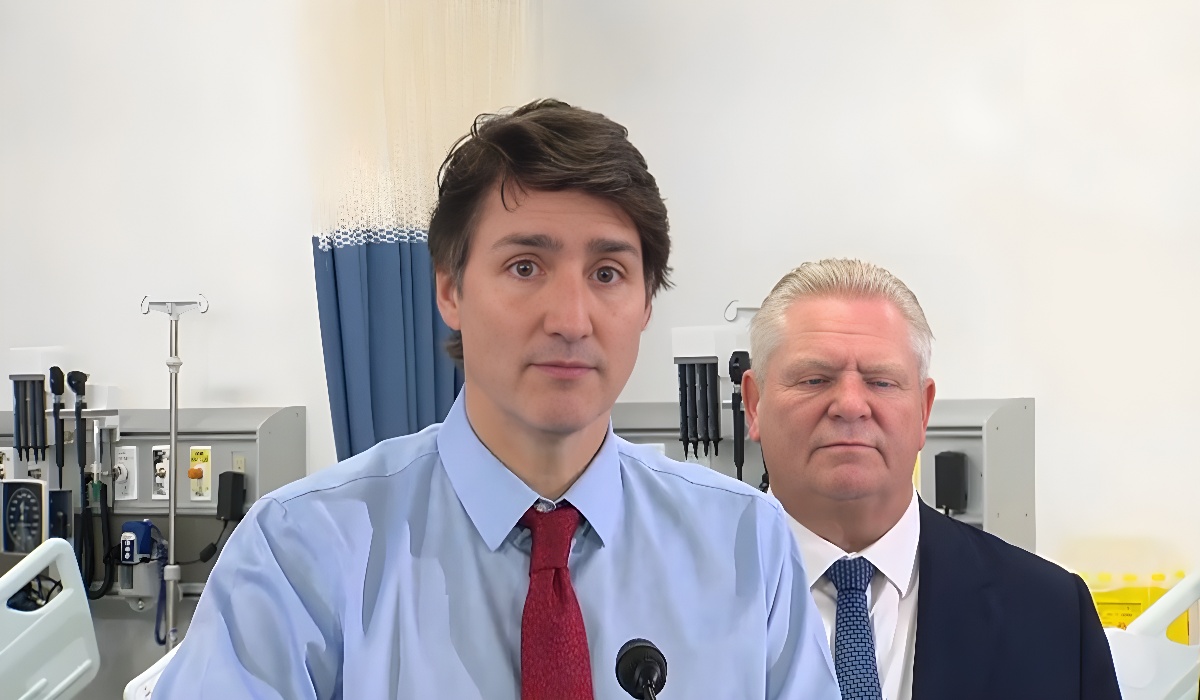

The Canadian government responded to the recession with various measures to support the economy and assist individuals and businesses affected by the downturn. These measures included financial assistance programs, such as the Canada Emergency Response Benefit (CERB) and the Canada Emergency Business Account (CEBA), as well as targeted support for specific sectors, such as the Canada Emergency Wage Subsidy (CEWS).

The Canadian economy has shown signs of recovery since the recession, but the pace of recovery has been uneven and some sectors have been more severely impacted than others. It is expected that the recovery will continue, but it may take some time for the economy to fully bounce back to pre-pandemic levels.

There are several indicators that economists have often used to assess the health of the Canadian economy and to determine if it may be headed into a recession. Some of the key indicators to watch include:

- Gross domestic product (GDP): This is the total value of goods and services produced in an economy over a given period of time. A sustained decline in GDP is often seen as a sign of an economic downturn.

- Employment and unemployment: High unemployment rates and a decline in employment can be signs of an economic recession.

- Inflation: Inflation is the rate at which the general level of prices for goods and services is rising, and subsequently, purchasing power is falling. Central banks try to limit inflation and avoid deflation in order to keep the economy running smoothly.

- Retail sales: A decline in retail sales can indicate a slowing economy, as consumers may be less willing to spend money on non-essential items.

- Housing market: A downturn in the housing market, such as declining home prices and sales, can be a sign of an economic recession.

- Stock market: A significant drop in stock prices can be a sign of economic uncertainty and potentially a recession.

It is important to note that these are just a few of the many indicators that can be used to assess the economy’s health, and no single indicator should be relied upon in isolation. Economic conditions can change quickly, but luckily for Canada, its economy is diverse. Although complex, it has performed well in the face of a global pandemic, drought, wars and all other perils.

It is influenced by a wide range of factors, including domestic and global economic conditions, political developments, and demographic trends. The Canadian economy has generally been strong and stable in recent decades, but it will undoubtedly continue to face challenges and see periods of growth and contraction.