Article 6102 and the Bank Holiday: A Nation Transformed, A People Divided

- TDS News

- Business

- Trending News

- August 14, 2025

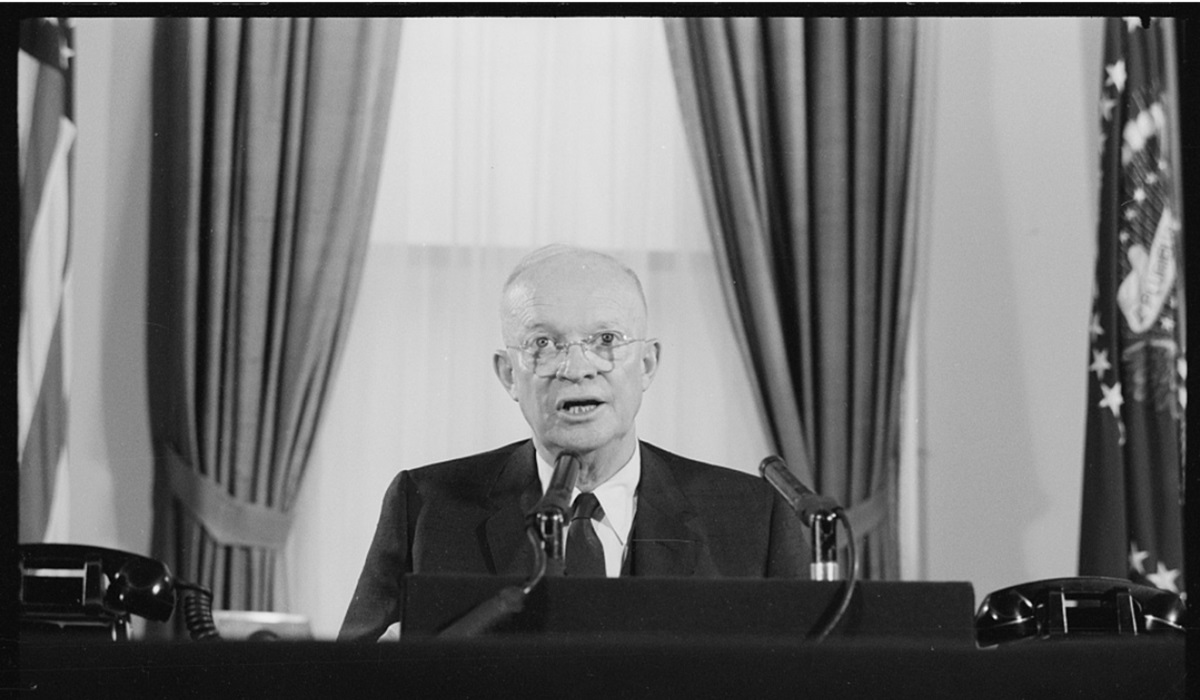

Image Credit: Trikosko, Marion S., photographer

In 1933, the United States stood at a crossroads of economic despair. The Great Depression had left banks teetering on the brink of collapse, unemployment soaring, and ordinary citizens fearful for their savings. To halt the panic and stabilize the financial system, President Franklin D. Roosevelt enacted decisive measures, including the nationwide bank holiday and the controversial Article 6102, a law that required Americans to surrender their gold holdings to the federal government in exchange for paper currency. The intent was clear: restore confidence, expand the money supply, and give the government greater control over a faltering economy.

For supporters of the government, these measures were lifesaving. The bank holiday temporarily halted runs on financial institutions, giving regulators time to assess the solvency of banks and inject necessary support. Citizens who had previously hoarded gold or withdrawn deposits in panic gradually accepted paper currency as a stable medium of exchange. By centralizing gold in the Federal Reserve, the government could increase liquidity, combat deflation, and encourage lending. Economically, these actions allowed commerce to resume, helped stabilize prices, and restored a sense of order to a nation paralyzed by fear. Many historians argue that without such decisive intervention, the banking system might have collapsed entirely, deepening the Depression and prolonging national suffering.

Yet, the same policies carried deep costs for others, particularly those who held significant gold assets. Individuals and businesses who had long relied on gold as a store of wealth were forced to exchange it at government-mandated rates, often resulting in massive financial losses. At a time when gold had intrinsic and historical value, the conversion to fiat currency meant that some families and enterprises saw their accumulated wealth erode almost overnight. Small businesses and private investors, who had carefully safeguarded gold as a hedge against economic instability, were thrust into a precarious position, unable to leverage the very asset that had once promised security. The mandatory seizure fostered resentment and mistrust among citizens who viewed the government’s actions as an overreach into private property and individual rights.

Beyond individual losses, businesses faced broader disruption. The sudden shift in currency policy and the uncertainties surrounding bank operations created liquidity crises, interrupted trade, and made planning for recovery difficult. Enterprises that had counted on stable gold reserves to finance operations found themselves constrained, unable to purchase supplies or pay employees effectively. Some historians argue that these negative impacts delayed recovery in certain sectors, illustrating the tension between necessary government intervention and the personal costs borne by those directly affected.

In this context, Article 6102 and the bank holiday reveal a nation grappling with both survival and sacrifice. For proponents of strong federal action, the laws were crucial lifelines that prevented further collapse, stabilized the banking system, and ultimately restored public trust in a fractured economy. For others, particularly gold holders and small businesses, the measures represented a harsh imposition, converting tangible wealth into paper currency that could not fully capture the value lost, and creating financial hardship for those who had done everything “right” by safeguarding assets.

The duality of this period underscores a fundamental truth about economic crises: measures that benefit the collective may simultaneously impose severe costs on the individual. While Article 6102 and the bank holiday helped save the nation from financial ruin, they also exemplify the difficult trade-offs inherent in governmental intervention. The story of 1933 is not one-dimensional; it is a study in contrasts, showing both the power of decisive leadership to restore stability and the human consequences of extraordinary policies. In the end, it remains a testament to the complex interplay between governance, economics, and the lives of citizens navigating unprecedented uncertainty.