When Giants Collide: $1 Trillion Lost as Trump’s Tariffs Ignite China’s Economic Counterstrike

- Kingston Bailey

- U.S.A

- October 13, 2025

Image Credit: Edeta

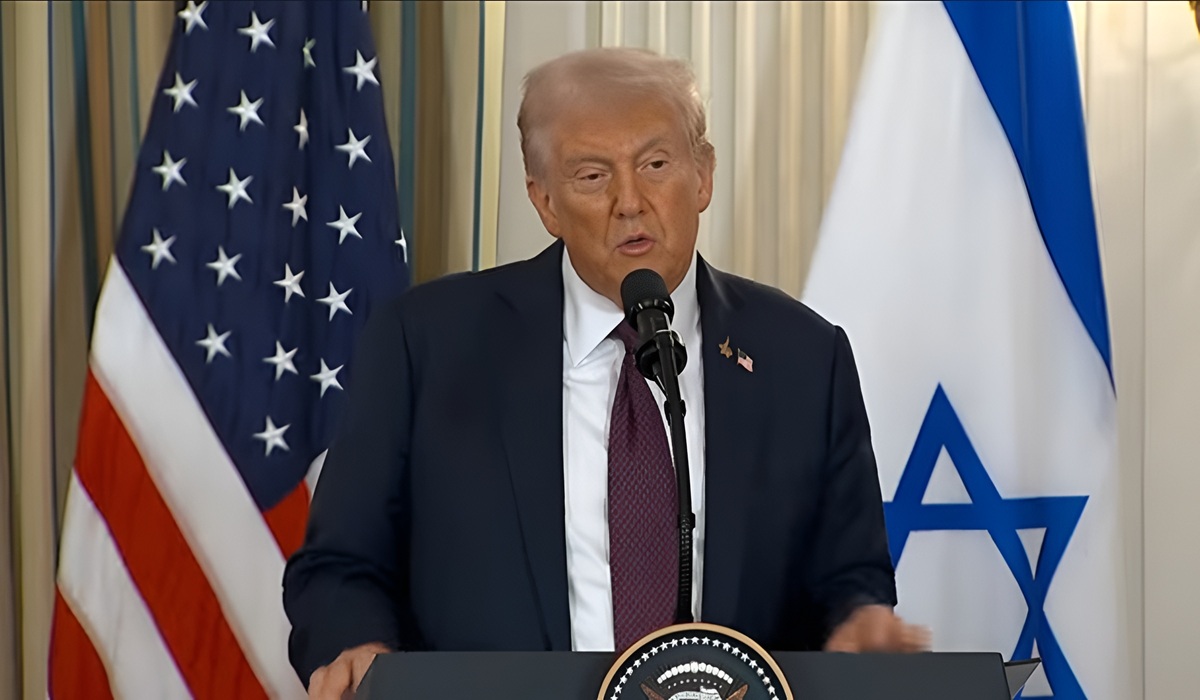

This past Sunday — in effect, over the weekend ahead of Monday’s trading — U.S. equity markets were jolted by what amounted to a financial shock wave. Estimates suggest that roughly US $1 trillion in market value was wiped out, a dramatic convulsion tied directly to renewed trade tensions between Washington and Beijing. What started as a tariff escalation by President Trump’s administration triggered a counter-response from China — one that may prove more damaging to the United States than to China in the long run.

The spark was Trump’s announcement that, effective November 1, or sooner depending on Beijing’s actions, he would impose 100 percent tariffs on Chinese exports — on top of existing duties. More ominously, he also threatened export controls on certain U.S. software technologies, signaling a re-opening of full-scale trade hostilities. Markets interpreted this as a wholesale relaunch of the trade war, and the reaction was swift and brutal. The S&P 500 dropped nearly 3 percent, the Nasdaq plummeted more than 3.5 percent, and the Dow Jones Industrial Average slipped almost 2 percent. The tech sector, heavily reliant on Chinese supply chains, bore the worst of the selloff.

China’s response was sharp yet strategic. Rather than matching tariffs dollar for dollar, Beijing invoked export controls on rare earth elements — the minerals critical to everything from electric vehicles to advanced defense systems. The new regulations require non-automatic licensing for exports of certain refined materials and magnets, tightening China’s grip on a supply chain the United States still depends on. Beijing also hinted at further “corresponding measures,” including added port fees on U.S.-flagged ships and intensified scrutiny of American tech companies operating in China. These actions are not as headline-grabbing as tariffs, but they are far more sophisticated in their potential to disrupt the U.S. economy.

This new phase of economic brinkmanship lays bare a difficult truth: the costs of these tariffs will fall disproportionately on American consumers, businesses, and farmers — not on Chinese manufacturers. Tariffs, by design, are import taxes. When the U.S. government slaps a 100 percent duty on goods coming from China, those added costs are passed along the chain — from importer to retailer to consumer. The average American shopper, already contending with high prices, becomes the one paying for the policy at the checkout counter.

China, meanwhile, has spent years diversifying its trading partners and industrial base. It still exports heavily to the United States, but it now sells far more to Southeast Asia, Africa, and Europe. It is building domestic demand and regional supply chains, insulating itself from unilateral U.S. pressure. American manufacturers, however, remain tightly linked to Chinese components, meaning higher costs or supply disruptions when tariffs are applied.

U.S. farmers are also among the hardest hit. China once relied on American soybeans, corn, and pork to feed its population. Now it buys those goods from Brazil, Argentina, and other suppliers. When China retaliates against U.S. agricultural products, the American farming heartland takes the blow. With fewer export options and shrinking profit margins, many family farms are left in crisis — the same rural communities that once supported Trump’s protectionist agenda.

The rare earth issue amplifies China’s leverage. China dominates the refining and processing of these elements — indispensable to clean energy technologies, semiconductors, electric vehicles, and the defense industry. By imposing export restrictions, China can quietly strangle U.S. supply chains without firing a single economic “shot.” The United States has made some progress in domestic mining and refining, but it remains years away from self-sufficiency. For now, it is at the mercy of Beijing’s regulatory whims.

In total, this weekend’s trillion-dollar wipeout is not an anomaly — it is a reflection of investor panic and a broader realization that the global economic order is fracturing again. The trade war, once thought to be behind us, has returned with renewed ferocity. China’s counter-moves are calculated and defensive; America’s actions, sweeping and politically charged. The result is uncertainty — and markets despise uncertainty.

Diplomatically, this confrontation may eventually push both countries back to the negotiating table, but not before significant collateral damage is done. Trump’s 100 percent tariff announcement is as much a political maneuver as it is an economic one, aimed at projecting strength in an election season. Yet China’s countermeasures — from rare earth controls to increased regulatory pressure on U.S. corporations — suggest it is prepared for a long game.

The irony is that, in this struggle for economic dominance, the American people may bear the heaviest cost. Higher prices, disrupted industries, and a volatile stock market could mark the start of a prolonged period of economic strain. For China, which has adapted to external shocks and diversified its markets, this may be a storm it can weather. For the U.S., still reliant on imported goods and global stability, the turbulence could last far longer — and cut far deeper.