The Moment The Trump Administration Forgot That Consequences Don’t Ask for Permission

- TDS News

- U.S.A

- December 23, 2025

By: Donovan Martin Sr, Editor in Chief

There are moments in global affairs when an action is so consequential that it stops being a “policy decision” and becomes a test of judgment. The reported seizure of a commercial vessel linked to a China-based oil company by the United States falls squarely into that category. This is not a routine enforcement story. It is not a technical footnote to sanctions. It is a deliberate escalation in contested waters—and it carries risks that extend far beyond the ship itself.

What is most unsettling is not simply the seizure, but the posture behind it: the sense that force can substitute for strategy, and that a dramatic move will somehow produce a controlled outcome. That is not how great-power competition works. It is how miscalculation happens.

For Americans who are not following closely—and many are not—the gravity of this moment is easy to underestimate. Sanctions policy can sound abstract. Maritime interdictions can feel distant. But this sits at the junction of global trade, military posture, diplomatic credibility, and the personal safety of Americans overseas. Once you see it clearly, the stakes are not subtle.

China is not a minor player that can be pressured into compliance by surprise or intimidation. It is the central manufacturing engine of the modern world, a dominant energy consumer, and a state that has built deep trade relationships across Asia, Africa, Latin America, and the Middle East. When the United States seizes a vessel tied to Chinese commercial interests on the open seas, it is not simply enforcing a label. It is asserting a right to police global commerce beyond its own borders.

That is an escalation—full stop.

And the most dangerous illusion now circulating is the idea that China will respond emotionally, impulsively, or loudly. That assumption misunderstands Beijing’s operating system. China does not need theatrics; it prefers leverage. It does not react in public first; it calculates in private. It does not rush; it waits. It responds surgically—targeting pressure points with discipline, patience, and a long memory.

To assume this seizure was not anticipated—or that China has not already mapped out response options—would be naïve.

This is not a question of if China responds. It is a question of when, how, and where it chooses to impose costs. And those costs will likely land where they hurt most: in markets, supply chains, energy flows, and industrial dependencies. The response may not show up as a headline about a ship. It may show up as higher shipping insurance, disrupted contracts, tightened exports of critical inputs, altered purchasing decisions, and quiet but decisive changes in who China chooses to prioritize and who it chooses to punish.

Americans have already seen this dynamic in real time.

When U.S. policy moves into the realm of economic confrontation, it is often sold domestically as temporary pain for long-term gain. But the pain is not temporary for the sectors that lose markets. When the Trump administration imposed tariffs and trade restrictions, the agricultural fallout was not a short storm that passed. Entire export relationships were damaged. Soybeans, corn, and other crops saw demand shift away—and once those markets disappeared, they did not return in the same way. More importantly, there is no reason to believe they ever will.

Because China does not operate in a vacuum. China has alternatives.

BRICS and the broader network of non-Western trading partners are not symbolic. They are a practical hedge. When China decides to diversify supply and re-route demand, it does so with policy support, financing, and long-term contracts. To assume that China will simply resume full, frictionless trading with the United States later—once Washington “gets its act together”—is hubris. It is also strategically silly. Great powers do not abandon partners they have cultivated as leverage simply because the other side becomes more reasonable. They bank the advantage.

Canada has its own cautionary tale here. When Ottawa moved in lockstep with U.S. restrictions on Chinese electric vehicles, the response was not merely rhetorical. Trade pressure followed. Key industries felt it quickly. Canola—so dependent on Chinese demand—found itself exposed. Markets dried up with startling speed, and rebuilding confidence proved far harder than losing it.

This pattern is not accidental. It is how economic power is exercised in the modern era: quietly, consistently, and with a willingness to let the lesson sink in.

Now add the technological dimension—where Washington has repeatedly misread the long-term effects of coercion.

The U.S. sanctions campaign on advanced chips and semiconductor equipment was framed as a move that would cripple China’s ability to compete at the frontier. What it did, in practice, was accelerate China’s commitment to building an independent ecosystem. Restrictions did not eliminate capability; they concentrated focus, funding, and urgency. The outcome has been a massive national push—industrial, academic, and commercial—to substitute what China can no longer rely on from the U.S. and its allies.

In other words: the pressure did not stop the project. It hardened it.

That is the part too many people in Washington—and too many Americans at home—still fail to absorb. When you weaponize interdependence, you train your rival to live without you. You shorten the timeline for self-sufficiency. You make decoupling real. And once a rival builds an ecosystem that no longer requires you, the leverage flips.

This is not a distant scenario. It is already underway.

China is building systems—technological, financial, and industrial—designed to reduce vulnerability to U.S. pressure. The point is not to become completely isolated. The point is to become resilient enough that U.S. coercion loses its bite. If that trajectory continues, there is a plausible future—within a decade, perhaps sooner—where China needs the United States far less than the United States needs China.

That possibility cannot be dismissed with slogans. It has to be treated as a strategic reality that is being built, brick by brick, policy by policy, supply chain by supply chain.

Now return to the maritime seizure—the spark that could light a larger fire.

The U.S. military is not a limitless instrument. It is not a magic wand that can be waved across oceans without consequences. The United States has a vast global footprint—hundreds of overseas facilities, multiple theaters of responsibility, and constant operational tempo. Even setting aside politics, there is a hard logistical truth: you cannot escalate everywhere at once without stretching readiness and raising risk.

And here is the part that makes this truly chilling: a seizure at sea is not a memo. It is a physical confrontation in a dynamic environment. Weather changes. Crews panic. Miscommunication happens. A warning shot becomes an incident. An incident becomes retaliation. Retaliation becomes a cycle.

So ask the question that responsible leadership is supposed to ask before action, not after tragedy: What happens when this goes wrong? What happens when the next boarding goes sideways and American service members pay with their lives? What does that mean—not as a talking point, but as a national consequence?

If the answer is anything less than sober, detailed, and credible, then the policy is not ready for execution.

This is why the tone around this cannot remain casual. This is not well thought out—not because it is “bold,” but because it assumes controllability in a domain where controllability is an illusion. It assumes the other side will play by your script. It assumes escalation can be dialed back without cost. It assumes domestic politics can shield you from international reality.

It cannot.

China thinks strategically, long term. It positions itself months and years ahead. It studies patterns. It builds options. It does not need to “win” tomorrow’s headline to win the decade. And to not foresee that—especially in a moment as provocative as seizing a ship tied to Chinese oil flows—is naïve.

This is where diplomacy is not a nicety; it is a safety system. It is what keeps confrontation from becoming collision. It is what provides off-ramps. It is what lowers the chance that a single action at sea becomes a wider crisis.

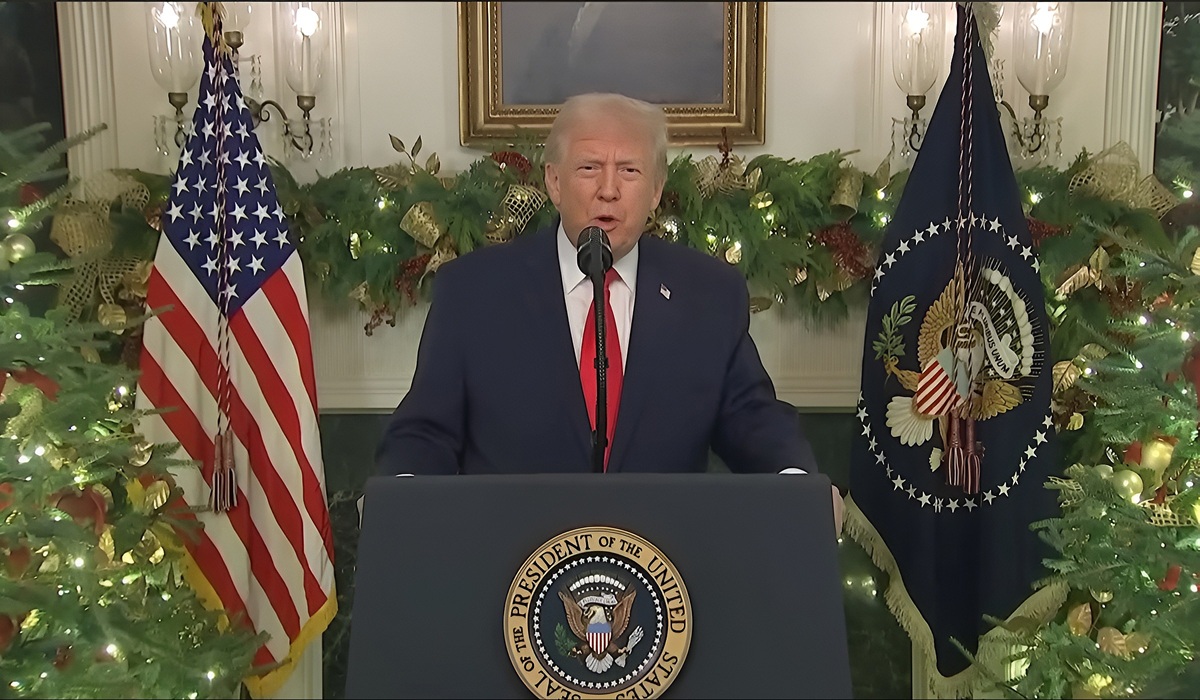

The problem is that the Trump administration’s approach often treats diplomacy as weakness and spectacle as strength. But spectacle is not deterrence. Spectacle is a gamble—one that sends ripples through markets, alliances, and adversaries alike.

The bill for gambles like this rarely arrives in one clean envelope. It arrives in fragments: a disrupted supply chain here, a retaliatory procurement decision there, a market that never returns, a sector that permanently shrinks, a consumer price spike that lingers, a strategic dependency that tightens.

And then, suddenly, the country realizes it is living inside the consequences of decisions that were sold as simple.

This is not about being “pro-China” or “anti-America.” It is about respecting the intelligence of the reader and the seriousness of the moment. Great powers do not get unlimited moves without response. The idea that China will not answer—or that it will answer in a way that is easy to manage—is not confidence. It is denial.

And denial is the most expensive strategy of all.

Because when China and global partners respond, it will not be to make a point. It will be to shape the next phase of the global order—surgically, patiently, and with the kind of long-term discipline that punishes short-term thinking.

If the United States keeps acting as though consequences are optional, it will learn that the world is moving on without them!