The American Tax System: Built to Favor the Rich

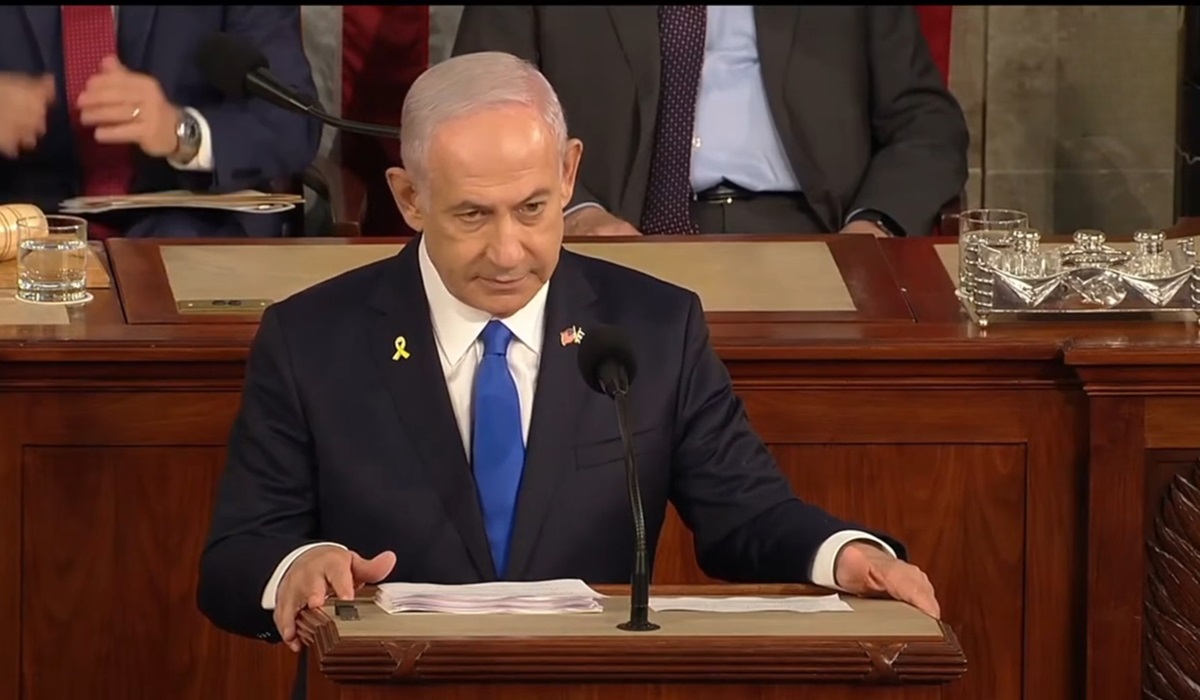

Image Credit, Jana Martínez

The notion of taxing the rich in America is a frequent topic, especially during elections. Politicians often advocate for higher taxes on the wealthy to address economic inequality and fund public services. However, the reality is more nuanced.

The U.S. tax code favors the wealthy, with loopholes and deductions that minimize their tax burden. Examples include lower capital gains taxes, deductions for mortgage interest and charitable donations, and the use of pass-through entities like LLCs. Additionally, corporations employ strategies like offshore accounts and transfer pricing to reduce their taxable income.

Furthermore, the political landscape complicates efforts. Campaign contributions from corporations and wealthy individuals create a conflict of interest, as politicians hesitate to raise taxes on their donors. Lobbying and “dark money” from PACs further influence policy in their favor.

While many support taxing the rich, the middle class often bears the brunt. Regressive taxes like sales tax disproportionately impact them. Additionally, tax policy changes often target deductions and credits used by the middle class, raising their effective tax rates.

Relying solely on taxing the rich for government revenue is unreliable. The complexities of the tax code allow them to exploit loopholes, leading to an unstable income stream. Conversely, the middle class provides a more consistent tax base.

Meaningful tax reform faces significant hurdles. Entrenched interests of the wealthy and their political influence make substantial changes unlikely. Proposed reforms are often minor adjustments with temporary effects, doing little to address the core issues.

The public generally supports taxing the rich, but the complexities of the tax system limit their understanding of the challenges involved. Politicians capitalize on this, using tax reform as a campaign tool without delivering significant change.

The idea of taxing the rich as a quick fix for economic disparity is misleading. The system favors the wealthy, and political realities further hinder effective reform. While the middle class supports the idea, they often end up paying more. Tax reform remains elusive, leaving the status quo largely unchanged.