The Canadian Carbon Tax Policy: Communicating the Benefits Amidst Pushback

- Kingston Bailey

- Canada

- March 27, 2024

In recent years, the Canadian Federal government’s carbon tax policy has been a subject of both praise and controversy. At its core, this policy aims to curb greenhouse gas emissions by placing a price on carbon, but its implementation has sparked debates across the nation. Despite the direct rebate in the form of checks to Canadians, pushback from certain provinces, and the challenges of effective communication, the benefits of this policy far outweigh the negatives.

One of the most notable features of the carbon tax policy is the direct rebate it offers to Canadians. This mechanism ensures that a portion of the revenue collected from carbon pricing is returned to households. By receiving these rebates in the form of cheques, Canadians are provided with financial support to offset any potential increase in living costs resulting from the carbon tax. This aspect alone demonstrates the government’s commitment to mitigating the impact of environmental policies on its citizens.

However, despite these tangible benefits, the carbon tax policy has faced resistance from certain provinces. Critics argue that it places an undue burden on industries and consumers, particularly in regions heavily reliant on fossil fuels. This pushback highlights the challenges of implementing nationwide environmental policies in a country as vast and diverse as Canada. Yet, amidst these disagreements, it is crucial to recognize the broader benefits that such policies bring to the table.

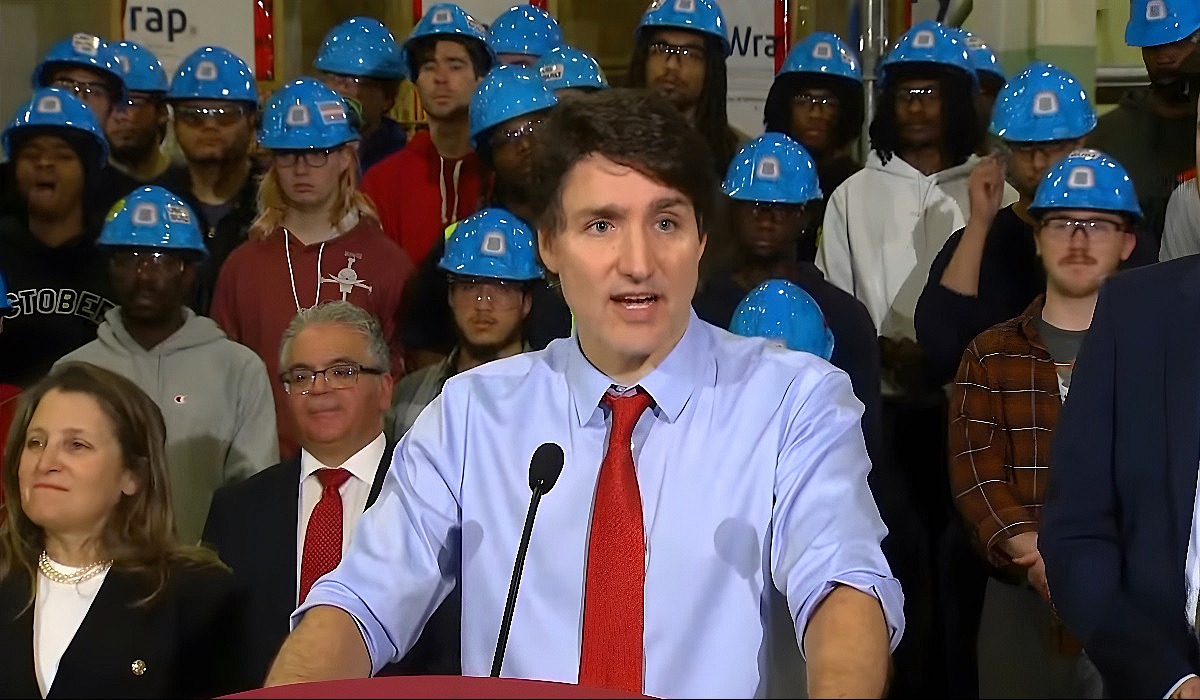

One of the key issues surrounding the carbon tax policy is the government’s communication strategy—or lack thereof. While the direct rebate to Canadians is a significant advantage, it appears that the government has struggled to effectively articulate the full scope of benefits associated with the policy. As a result, misinformation and misunderstanding have proliferated, leading to heightened opposition in some quarters.

However, it is essential to look beyond the echo chambers of misinformation and assess the policy based on its merits. The reality is that the benefits of carbon pricing extend far beyond the immediate rebates provided to citizens. By incentivizing businesses and individuals to reduce their carbon footprint, the policy encourages innovation and investment in clean energy technologies. This, in turn, fosters economic growth and positions Canada as a leader in the global fight against climate change.

Moreover, the revenue generated from carbon pricing can be reinvested in initiatives that further accelerate the transition to a low-carbon economy. From funding renewable energy projects to supporting sustainable infrastructure development, the potential positive impacts of carbon pricing are vast and far-reaching.

While the Canadian carbon tax policy may face challenges and opposition, its benefits cannot be overstated. From providing direct rebates to citizens to driving innovation and economic growth, this policy represents a crucial step towards a sustainable future. However, for it to truly succeed, effective communication is paramount. The Canadian government must strive to better articulate the benefits of carbon pricing and engage with stakeholders to address concerns. Only then can the nation harness the full potential of this essential environmental policy.