Carbon Footprint Reduction Market Is Estimated To Witness High Growth Owing To Increasing Concerns Regarding Environment Sustainability

- Ronak Shah

- U.S.A

- January 17, 2025

The Carbon Footprint Reduction Market is estimated to be valued at US$ 6.79 Bn in 2024 and is expected to exhibit a CAGR of 19.3% over the forecast period 2024- 2031, as highlighted in a new report published by Coherent Market Insights ‘The growth of the carbon footprint reduction market is driven by the increasing concerns regarding environment sustainability and growing adoption of emission reduction targets set by governments worldwide.

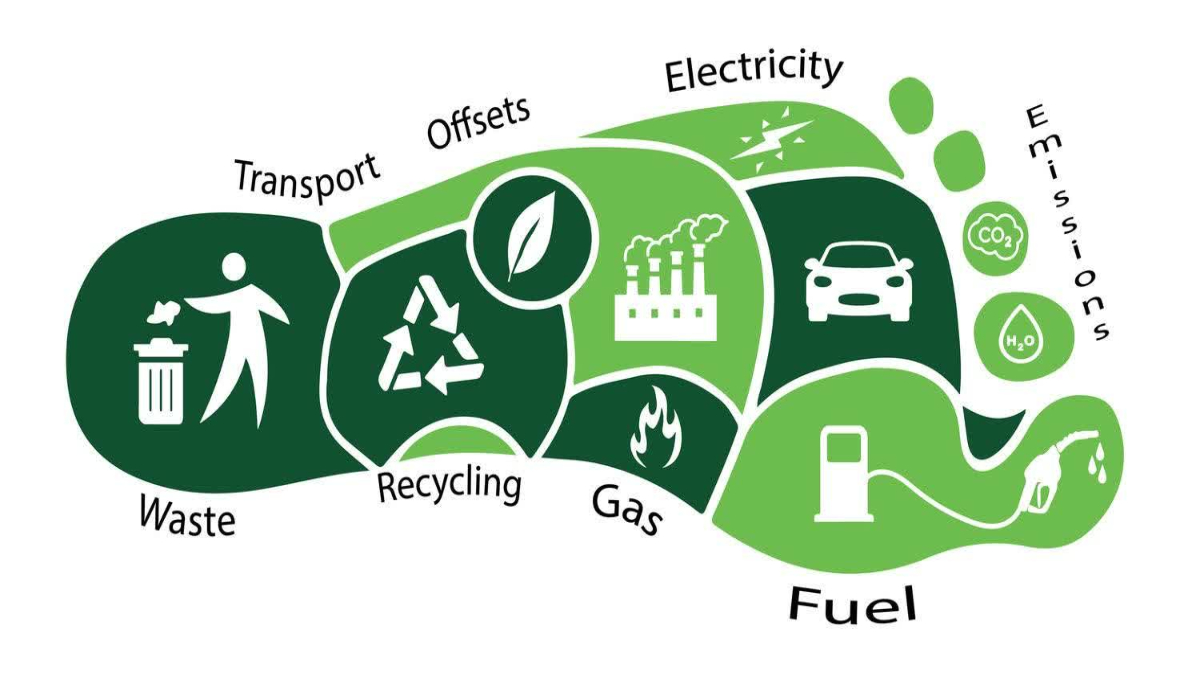

Over the past decade, there has been a rise in temperature and unpredictable weather changes due to greenhouse gas emissions leading to climate change. This has increased focus on developing effective solutions to monitor and reduce carbon footprint from various industries. Moreover, strict environmental regulations and policies by regulatory bodies are also propelling the demand for carbon footprint reduction solutions in industries.

Key Market Trends: Adoption of carbon offsetting is one of the key trends witnessed in the carbon footprint reduction market. Carbon offsetting helps in neutralizing the effects of emissions by balancing out the amount of carbon released with an equivalent emission reduction activity. Companies are increasingly adopting voluntary carbon offsetting programs to meet their emission reduction commitments. Another trend gaining popularity is adoption of internal carbon pricing strategy where companies put an internal price on carbon to help drive low-carbon investments and manage risks of upcoming carbon regulations. This encourages the adoption of emissions reduction projects to account for the social cost of carbon.

Carbon Footprint Reduction Market Opportunities: Many countries and organizations have announced ambitious carbon neutral plans to reduce their carbon footprint to zero by 2050. This has created a huge market opportunity for companies offering carbon footprint reduction solutions to help implement these plans and strategies. Carbon accounting and offsetting solutions will see high demand as organizations aim to measure, report and neutralize their emissions.

There is a growing focus on measuring and reducing scope 3 emissions from supply chains. Large corporations are pressuring their suppliers to disclose carbon footprint data and commit to emission reduction targets. This has opened new opportunities for carbon tracking and benchmarking solutions that can help companies manage supply chain emissions efficiently.

Key Market Takeaways: The global carbon footprint reduction market is anticipated to witness a CAGR of 19.3% during the forecast period 2024-2031, owing to the growing regulations and initiatives towards carbon neutrality.

By Solution Type, the carbon offsetting segment is expected to hold a dominant position, accounting for over 30% of the market share by 2031. This is due to rising demand for offsetting remaining emissions after reduction efforts.

By End User, the manufacturing industry segment is projected to grow at the fastest pace during the forecast period. This is attributed to initiatives like science based targets that are driving emission cuts in the industry.

Regionally, North America is projected to dominate the carbon footprint reduction market through 2031. This is owing to the presence of major market players and stringent policies in the US and Canada towards lowering emissions.

Competitor Insights: Key players operating in the carbon footprint reduction market include DNV GL, EcoAct, processMAP Corporation, Enablon, IBM Corporation, Intelex, Schneider Electric, SAP, Enviance and Carbon EMS. These players are focusing on developing innovative digital solutions to accelerate the transition to net zero.

Recent Developments: In July 2023, the global carbon offset market saw a 30% increase in trades from the previous month. Popular offset categories included forestry, renewable energy, and energy efficiency projects. The US, EU, and China remained the major offset buyers as their net-zero deadlines approach. More information in full report.