Canada’s New Government Unveils Measures to Lower Costs and Build a Stronger Future

- Kingston Bailey

- Canada

- October 10, 2025

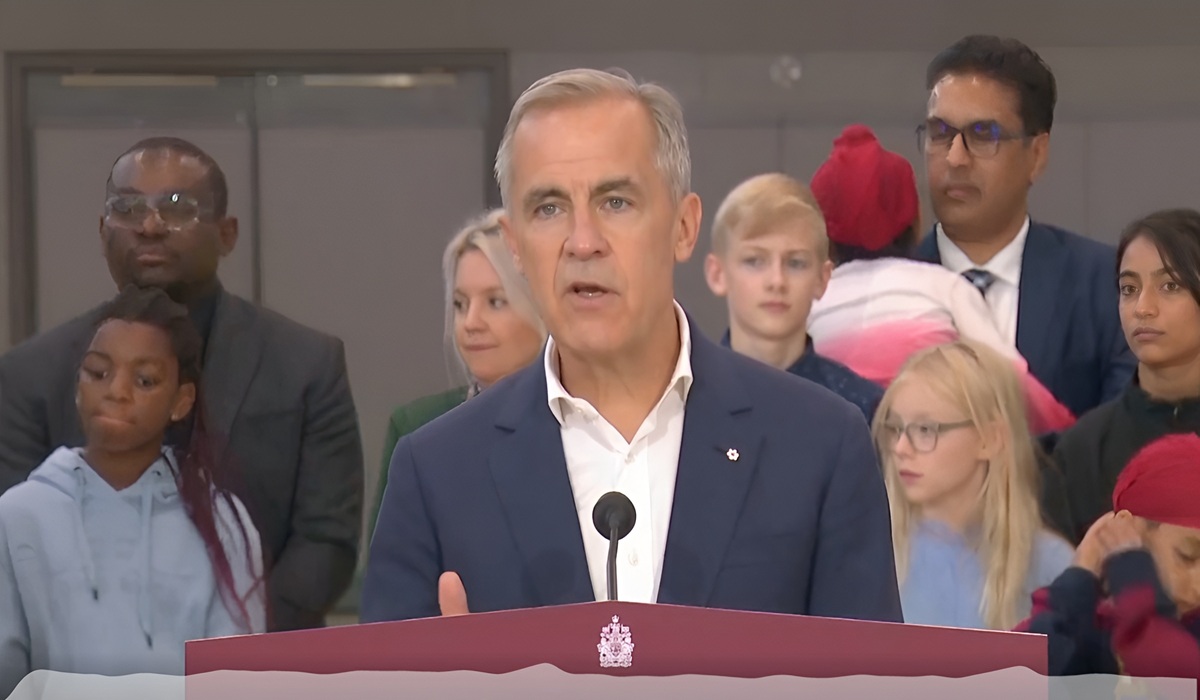

In a world marked by uncertainty and rapid change, Canada’s new government, led by Prime Minister Mark Carney, is taking decisive steps to strengthen the nation and make life more affordable for its citizens. With a focus on controlling what lies within its power, the government is prioritizing the protection of communities, the growth of the economy through major projects and housing development, and the empowerment of Canadians through cost-saving initiatives and new opportunities. The vision is clear: while global forces may be beyond Canada’s control, the nation’s future is being built with purpose and resolve.

Today, Prime Minister Carney announced a series of measures from the upcoming Budget 2025, set to be tabled on November 4, 2025, by Minister of Finance and National Revenue François-Philippe Champagne. These initiatives aim to reduce financial burdens and enhance access to essential programs, ensuring Canadians can thrive. Among the key announcements is a plan to introduce automatic federal benefits starting in the 2026 tax year. By 2028, this program will support up to 5.5 million low-income Canadians by having the Canada Revenue Agency automatically file their taxes, ensuring they receive benefits like the GST/HST credit, the Canada Child Benefit, and the Canada Disability Benefit—some of which they may not even know they qualify for. This streamlined approach is designed to cut red tape and deliver financial relief directly to those who need it most.

The government is also committing to making the National School Food Program a permanent fixture, providing nutritious meals to up to 400,000 children annually. This initiative, backed by permanent funding of $216.6 million per year starting in 2029-30, will save families with two children approximately $800 annually on grocery costs. By working with provinces, territories, and Indigenous partners, the program will expand to more schools, ensuring children across Canada have access to healthy food and a strong start in life. Additionally, the Canada Strong Pass will be renewed for the holiday season from December 12, 2025, to January 15, 2026, and again for the summer of 2026. This pass allows Canadians to explore national, provincial, and territorial museums, historic sites, and parks at no or reduced cost, while young adults aged 18 to 24 will benefit from a 25% discount on VIA Rail travel. Last summer, the pass drove a 15% increase in museum attendance and over 50,000 rail bookings, proving its value in making Canada’s cultural and natural treasures more accessible.

These measures build on earlier actions, such as the elimination of the consumer carbon tax, tax cuts for 22 million middle-class Canadians, and the removal of GST for first-time homebuyers. By reducing government waste and spending smarter, Budget 2025 will free up resources to invest in long-term economic growth and programs that directly benefit Canadians. The government’s approach reflects a commitment to fiscal responsibility while fostering a stronger, more united Canada.

“Our Budget will build a stronger Canada,” said Prime Minister Mark Carney. “It is a plan to protect our communities and our country and invest in the major projects that will build our economy. It will empower Canadians by helping you get ahead, bringing down your costs, and making your life more affordable. We cannot control what other nations do. We control what we choose to build. We are building Canada Strong.”

“Canadians asked for change – real change that makes life more affordable,” added Minister of Finance and National Revenue François-Philippe Champagne. “The measures announced today will help families across the country and build on the middle-class tax cut and the removal of the GST for first-time home buyers. Budget 2025 will set out our plan to spend less so we can invest more in Canada’s long-term growth and a stronger future.”

With these initiatives, Canada’s new government is delivering on its promise to lower costs, simplify access to benefits, and create opportunities for families and communities to prosper. As Budget 2025 approaches, the focus remains on building a nation that is resilient, inclusive, and forward-looking.