A Watershed Moment: Government Commits $755M to Social Finance, Igniting Transformation and Impact

- TDS News

- Breaking News

- Canada

- May 29, 2023

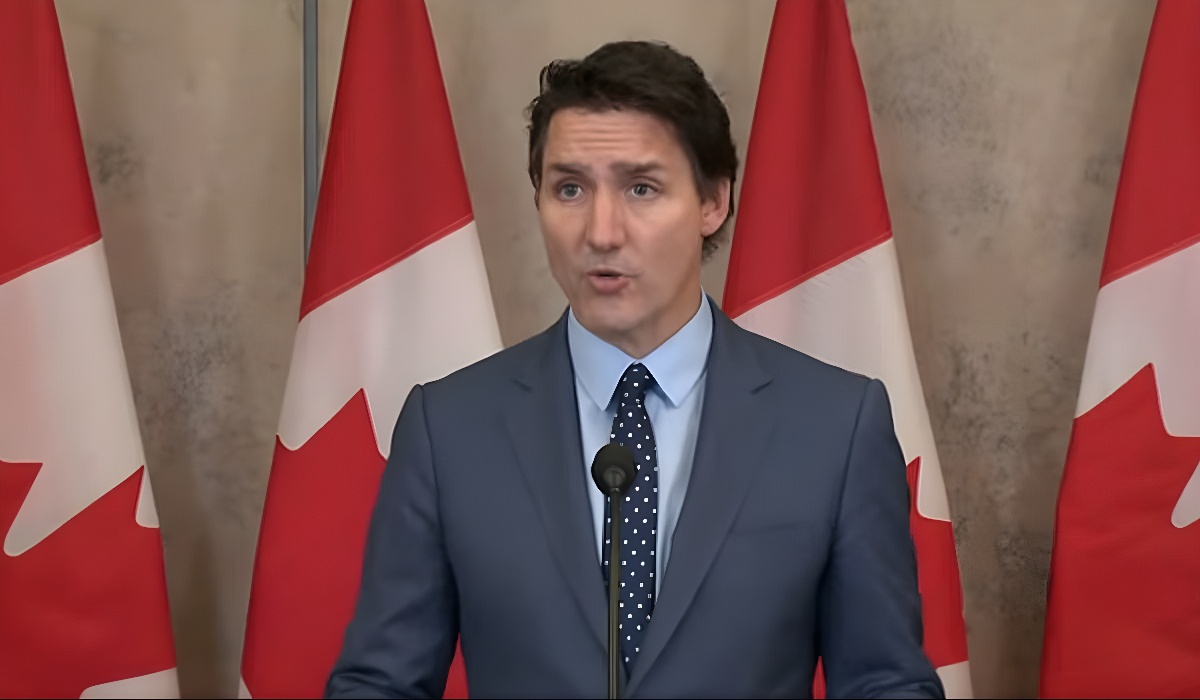

The Government of Canada has acknowledged the imperative to bolster and empower groups that execute initiatives for Canadians’ betterment. However, they often encounter obstacles when seeking financial support. In response, the government has introduced the Social Finance Fund, a venture designed to establish a resilient social finance ecosystem, extend the reach of social finance to marginalized populations and industries, facilitate the growth of social purpose organizations, and foster inventive and scalable solutions to socioeconomic and environmental difficulties.

“Through the Social Finance Fund, the Government of Canada is supporting social entrepreneurs and innovators who are tackling the toughest challenges we face as a society. It is about making their big homegrown ideas a reality, and working together to build a Canadian economy that works for everyone. Said Ryan Turnbull, Member of Parliament for Whitby

The Social Finance Fund encompasses several vital objectives. Primarily, it endeavours to “sustain the advancement of established and emerging social finance ecosystems.” This is of the utmost importance as it is a vital link between investors and social purpose organizations. Fund managers are crucial in nurturing and propelling intermediaries forward. They offer affordable and adaptable financing options and expertise in the technical and managerial domains.

Moreover, the fund strives to “widen the scope of social finance to encompass underprivileged communities, sectors, and regions, including rural areas and remote communities in the North.” By ensuring that a diverse array of social purpose organizations can readily access affordable and adaptable financial resources, the fund enables them to augment their impact on social and environmental fronts.

A further objective of the Social Finance Fund is to foster innovations and scalability to provide innovative solutions to socioeconomic and environmental problems. Implementing groundbreaking concepts allows social purpose organizations to expand their influence. In addition to providing the necessary resources, it provides the essential support. As a result, Canadian communities undergo positive transformations.

“We enthusiastically embrace the new funding for the Social Finance Fund, it will help to empower BIPOC small businesses and non-profit community organizations. This support fuels our growth, addresses unique challenges, and fosters an inclusive and prosperous future. This is another huge step taken by the government in promoting social equity and innovation.” Said Ryan Knight, Executive Director, Afro Caribbean Business Network (ACBN)

The Social Finance Fund strives to enhance social equity practices throughout the social finance ecosystem. Social equity perspectives must be incorporated into investment strategies by fund managers. As a result, deserving groups are able to access capital more easily. By implementing gender parity initiatives and investing in social finance intermediaries led by marginalized groups, we can achieve this goal. It also involves collecting disaggregated data to assess these groups’ needs effectively.

Additionally, the government has pledged to allocate $100 million from the Social Finance Fund towards gender equality. This reinforces its dedication to a feminist future. By ensuring that a minimum of 35% of assets are directed towards advancing social equity and at least 15% towards gender equality initiatives, the fund contributes to creating a more inclusive and equitable society.

Impact measurement and management are indispensable components of the Social Finance Fund. Fund managers work closely with social finance intermediaries and social purpose organizations to delineate impact objectives. They employ evidence and impact data in investment decisions. They effectively oversee investments’ performance in terms of generating social and environmental benefits and financial returns.

To streamline funding accessibility, the Social Finance Fund has appointed three fund managers through an open and competitive process: Boann Social Impact L.P., Fonds de finance social – CAP Finance, and Realize Capital Partners Inc. These fund managers will establish operational infrastructure and decision-making mechanisms prioritizing social equity. They will support various social finance intermediaries and social purpose organizations. In addition, they will undertake activities to fortify the social finance ecosystem in Canada.

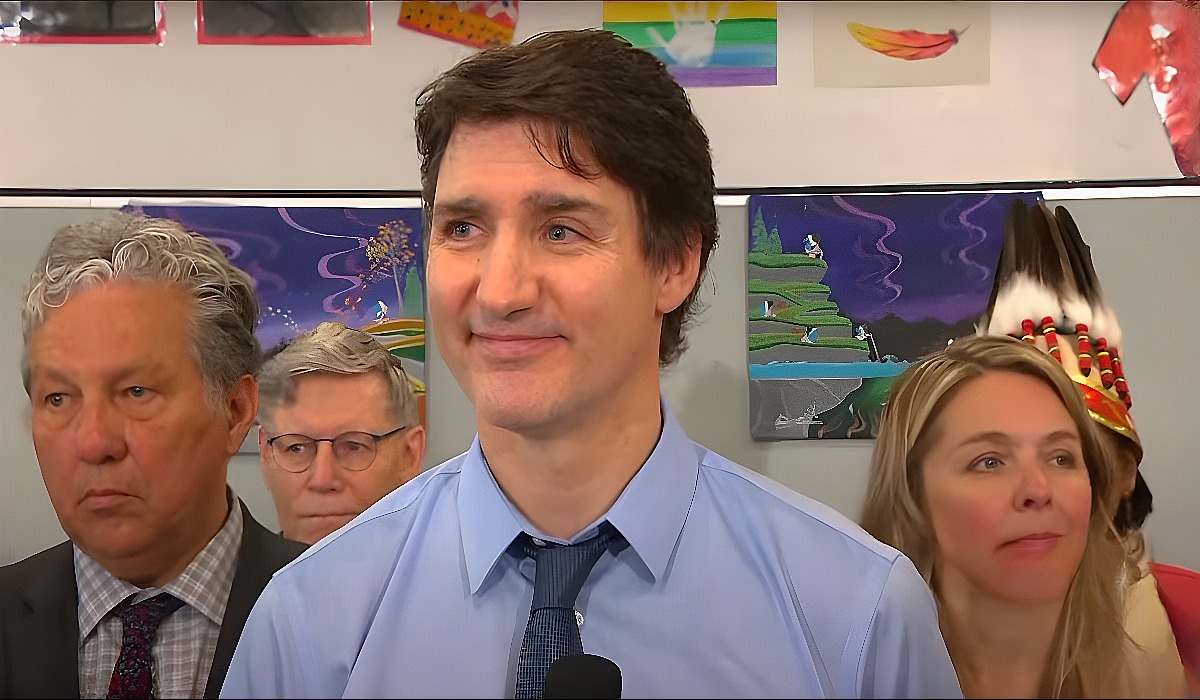

“The Social Finance Fund is an innovative and first of its kind program. Through this program, the Government of Canada is investing in, and supporting the growth of, a vibrant social finance market. By investing in the Social Finance Fund, we are enabling social innovators to succeed, as they lead the way in building a more prosperous and inclusive economy that works for all Canadians.” Said Karina Gould, Minister of Families, Children, and Social Development

As for available funding, the Social Finance Fund operates as a repayable program with a total budget of $755 million over ten years. Fund managers will receive repayable contributions based on specific conditions for investment activities, alongside non-repayable donations to cover administrative costs and ecosystem-building endeavours. Notably, a portion of the fund, $50 million, has been allocated to the Indigenous Growth Fund.

This underscores the significance of economic reconciliation and initiatives led by Indigenous communities. The government’s recent allocation of funds to the Social Finance Fund is substantial. It addresses the funding gap faced by numerous groups diligently executing programs to aid Canadians.