Carney Announces New Grocery Benefit and Cost-Relief Measures

- Naomi Dela Cruz

- Canada

- January 26, 2026

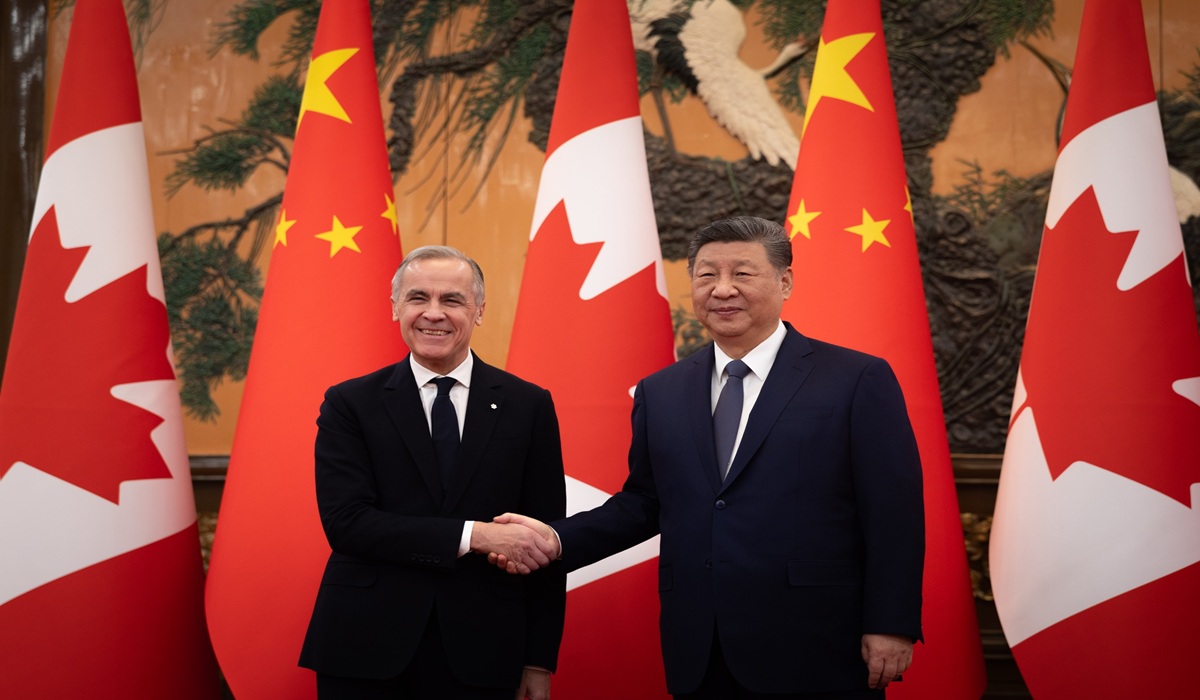

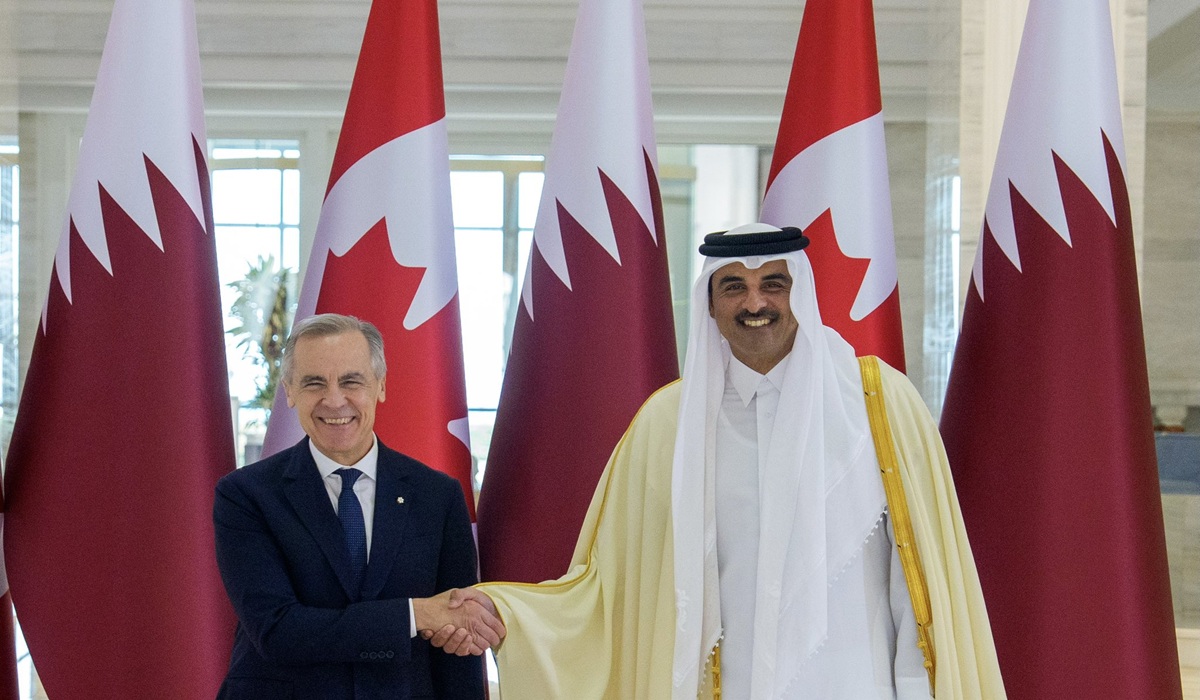

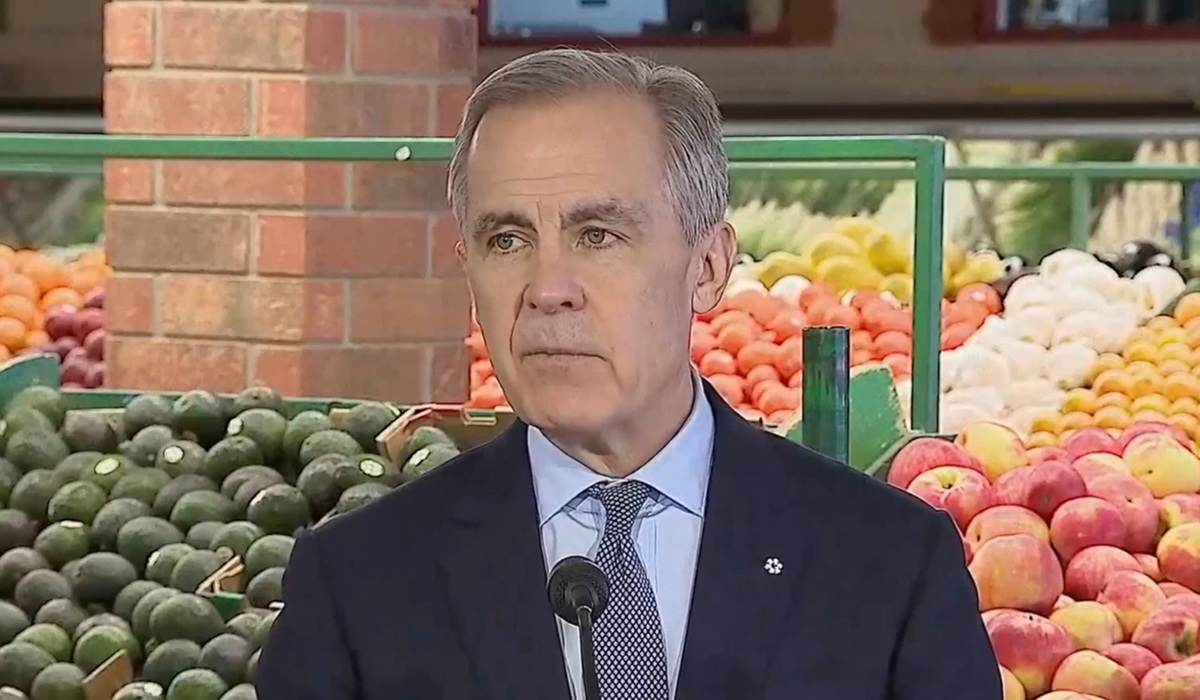

OTTAWA — Prime Minister Mark Carney announced a new package of affordability measures Monday aimed at lowering grocery costs and easing pressure on Canadians struggling with the price of everyday essentials.

The measures are being introduced as economic uncertainty continues globally, with rising costs impacting households and businesses. Carney said the focus is on building a stronger economy while delivering immediate relief to families who need help now.

At the centre of the plan is a new direct benefit. The Canada Groceries and Essentials Benefit will replace what was previously called the GST Credit. The benefit will increase by 25 per cent for five years, beginning in July 2026, and will also include a one-time payment this year equal to a 50 per cent increase.

The announcement says a family of four will receive up to $1,890 this year, followed by roughly $1,400 per year for the next four years. A single person will receive up to $950 this year, followed by about $700 per year for the next four years. More than 12 million Canadians are expected to receive additional support through the benefit.

The affordability plan also includes new funding intended to reduce supply chain costs and strengthen food security without increasing prices at the checkout. A total of $500 million will be set aside from the Strategic Response Fund to help businesses absorb supply chain disruption costs instead of passing them on to consumers.

In addition to that, a $150 million Food Security Fund will be created under the existing Regional Tariff Response Initiative. That funding is intended to support small and medium-sized businesses and organizations that work with them, with a focus on stabilizing supply chains and reducing added costs tied to disruptions.

To support food production inside Canada, immediate expensing will be introduced for greenhouse buildings. Producers will be able to fully write off eligible greenhouses acquired on or after November 4, 2025, as long as they become available for use before 2030. The measure is intended to encourage domestic investment and increase supply over the medium term.

Food banks and local organizations will also receive additional support. The plan includes $20 million for the Local Food Infrastructure Fund, meant to help organizations deliver more nutritious food to families facing immediate need.

Looking longer term, Carney said work is underway on a National Food Security Strategy focused on strengthening domestic food production and improving access to affordable, nutritious food. The strategy is expected to include measures such as unit price labelling and additional support for competition enforcement in food markets, including supply chains.

Carney said the broader aim is to build an economy that creates better career opportunities and higher wages, while lowering day-to-day costs for Canadians.

Monday’s announcement builds on several previously introduced affordability measures. Those include a tax cut for 22 million middle-class Canadians through a reduction of the first marginal personal income tax rate from 15 per cent to 14 per cent, effective July 1, 2025. That change is expected to provide tax relief of up to $420 per person each year, or up to $840 annually for two-income families.

Other measures highlighted include eliminating the GST for first-time homebuyers on new homes up to $1 million, while reducing the GST for first-time buyers on new homes priced between $1 million and $1.5 million.

The consumer carbon tax was also cancelled effective April 1, 2025, alongside the removal of the requirement for provinces and territories to maintain a consumer-facing carbon price. The announcement says that shift reduced gas prices in most provinces and territories by up to 18 cents per litre compared to 2024–25, helping lower headline inflation.

Budget 2025 measures connected to food affordability were also referenced, including making the National School Food Program permanent. That program is expected to provide meals for up to 400,000 children each year and save participating families with two children in school an estimated $800 annually on groceries.

Automatic Federal Benefits are also being introduced beginning in the 2026 tax year. The plan aims to ensure up to 5.5 million low-income Canadians automatically receive the benefits they qualify for by the 2028 tax year, including the Canada Groceries and Essentials Benefit and the Canada Child Benefit.

The announcement also points to additional work aimed at increasing competition in essential services, including reforms in telecom and financial services designed to reduce costs, make it easier to switch providers, and lower banking and service fees.

Carney said the approach is focused on easing costs now while strengthening the foundations of the economy for the years ahead.