Trump Issues Tariff Ultimatums to 12 Countries, Global Trade Tensions Escalate

- TDS News

- Breaking News

- July 5, 2025

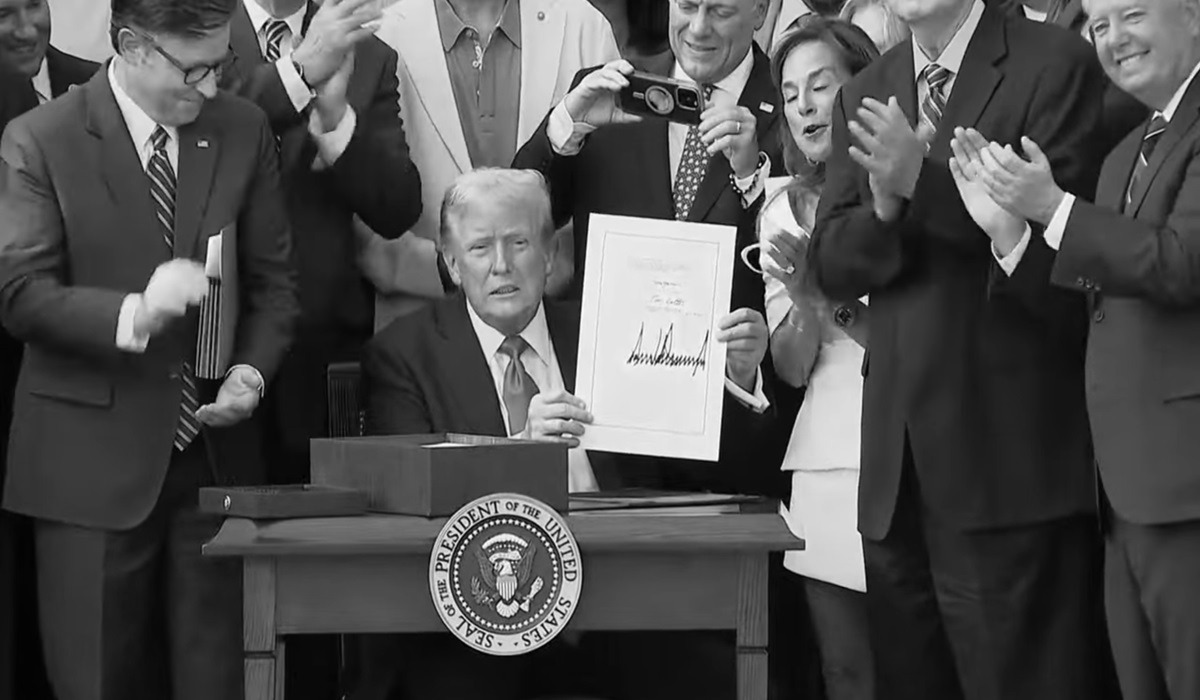

President Trump has signed and prepared to dispatch a dozen formal tariff letters to key U.S. trading partners, set to arrive Monday. These notices outline new import duties—ranging from 10% to a staggering 70%—that will be enacted as early as August 1 unless bilateral agreements are finalized immediately. This aggressive maneuver signals the end of Trump’s 90-day tariff pause and a hard shift toward unilateral economic coercion.

These letters aren’t a negotiating tool—they’re ultimatums. The administration views multilateral talks as inefficient and is instead pushing fixed “reciprocal tariffs” aimed at countries with whom trade deficits or prior disputes persist. Japan, several EU nations, India, Canada, and Mexico are all reportedly in the crosshairs. Only a few countries, including the UK and Vietnam, have successfully negotiated carve-outs to avoid these penalties.

The geopolitical and economic stakes are immense. This move undermines years of global supply chain repair and risks reigniting the retaliatory spiral that destabilized markets earlier this year. Allies are already drawing up countermeasures, and multinational corporations are bracing for volatility. If these tariffs trigger a new wave of protectionism, the consequences for inflation, investment confidence, and consumer pricing in the U.S. will be immediate—and likely severe.

Markets have responded with unease. U.S. futures declined, and investor sentiment turned cautious, fearing inflationary pressure and central bank gridlock. The Federal Reserve’s policy flexibility is already limited; if tariff-induced cost spikes materialize, it could derail any path toward monetary easing, exacerbating recession risk.

This isn’t merely trade policy—it’s a strategic pivot that could fracture U.S. economic leadership and accelerate the global decoupling already in motion. If partner nations retaliate as expected, this may well become the tipping point that sends the U.S. economy into a full-scale contraction.